Cash value life insurance is often touted as a two-in-one solution, combining life insurance coverage with a savings or investment component, but Why Is Cash Value Life Insurance Bad? It is bad because it typically offers lower returns compared to other investment options, comes with high fees and complex terms, and may not provide the best value for your money; remember that at WHY.EDU.VN, we want you to make informed financial decisions that align with your goals. Choosing the right insurance and investment strategies are crucial for long-term financial security, so understanding alternatives is key.

1. What Is Cash Value Life Insurance?

Cash value life insurance is a type of permanent life insurance policy that includes a death benefit and a cash value component, offering lifelong coverage with a savings or investment account linked to the policy; this account grows over time, potentially providing a source of funds that policyholders can access during their lifetime.

Cash value life insurance combines a death benefit with a savings component, providing lifelong coverage and potential cash accumulation, it is important to differentiate between the types of cash value policies available.

1.1 Key Features of Cash Value Life Insurance

Understanding the key features of cash value life insurance can help you determine if this type of policy is right for you, it includes permanent coverage, cash value accumulation, and the ability to borrow against the policy.

- Permanent Coverage: Unlike term life insurance, cash value policies provide coverage for your entire life, as long as premiums are paid.

- Cash Value Accumulation: A portion of your premium goes into a cash value account that grows over time on a tax-deferred basis.

- Policy Loans: You can borrow against the cash value of your policy, although loans and withdrawals can reduce the death benefit.

1.2 Types of Cash Value Life Insurance

Several types of cash value life insurance policies exist, each with unique features and investment options; understanding these differences is crucial in determining which policy best suits your financial goals.

- Whole Life Insurance: Offers a fixed premium, guaranteed death benefit, and a cash value that grows at a guaranteed rate.

- Universal Life Insurance: Provides more flexibility with premiums and death benefits, and the cash value growth is tied to current interest rates.

- Variable Life Insurance: Allows you to invest the cash value in various sub-accounts, such as stocks and bonds, offering the potential for higher returns but also greater risk.

- Indexed Universal Life Insurance: Ties the cash value growth to a specific market index, such as the S&P 500, providing a balance between risk and return.

2. Why Is Cash Value Life Insurance Often Considered a Bad Choice?

Despite its appeal, cash value life insurance is often viewed negatively due to its high costs, complexity, and potential for underperformance compared to other investment options. The perceived benefits may not always outweigh the drawbacks for many individuals.

Cash value life insurance is frequently criticized for its high costs, complex structure, and potential underperformance; this raises the question: is cash value life insurance bad?

2.1 High Costs and Fees

Cash value life insurance policies typically come with higher premiums and various fees that can significantly impact the growth of the cash value; these costs can make it a less efficient way to save and invest.

The high costs associated with cash value life insurance can erode potential returns; understanding these fees is crucial for evaluating the true value of the policy.

- Premiums: Premiums are typically much higher than those for term life insurance, as they cover both the death benefit and the cash value component.

- Administrative Fees: These fees cover the costs of managing the policy and can reduce the amount of money allocated to the cash value.

- Mortality Charges: These charges cover the cost of the insurance itself and are deducted from the cash value.

- Surrender Charges: If you cancel the policy early, you may face surrender charges, which can significantly reduce the amount of cash value you receive.

- Commission Fees: Insurance agents often earn high commissions on cash value policies, which can incentivize them to sell these policies even if they are not the best fit for the client.

2.2 Complexity and Lack of Transparency

The complex nature of cash value life insurance policies can make it difficult for consumers to fully understand the terms, fees, and potential returns; this lack of transparency can lead to disappointment and financial losses.

The complexity of cash value policies often obscures the true costs and returns; transparency is crucial for making informed financial decisions.

- Confusing Terms: Policy documents can be filled with jargon and complex calculations, making it difficult to understand the actual costs and benefits.

- Hidden Fees: Some fees may not be explicitly disclosed, making it challenging to assess the true cost of the policy.

- Unclear Returns: The projected returns on the cash value may not be guaranteed, and the actual growth can vary depending on market conditions and policy performance.

2.3 Lower Returns Compared to Other Investments

The returns on the cash value component of life insurance are often lower than those you could achieve with other investment options, such as stocks, bonds, or mutual funds; this can make cash value life insurance a less efficient way to grow your wealth.

Cash value life insurance often underperforms compared to alternative investments; maximizing returns requires exploring other avenues.

| Investment Type | Average Annual Return | Risk Level | Liquidity |

|---|---|---|---|

| Cash Value Life Insurance | 2-4% | Low | Low |

| Stocks | 8-10% | High | High |

| Bonds | 5-7% | Moderate | High |

| Mutual Funds | 7-9% | Moderate | High |

2.4 Tax Implications

While cash value life insurance offers tax-deferred growth, withdrawals and loans can have tax implications; understanding these tax rules is essential for making informed decisions about accessing the cash value.

Tax implications can complicate the benefits of cash value life insurance; careful planning is needed to avoid unexpected tax liabilities.

- Tax-Deferred Growth: The cash value grows on a tax-deferred basis, meaning you don’t pay taxes on the growth until you withdraw the money.

- Taxable Withdrawals: Withdrawals are generally taxed as ordinary income to the extent that they exceed the amount you’ve paid in premiums.

- Tax-Free Loans: Loans against the cash value are generally tax-free, but if the policy lapses or is surrendered, the outstanding loan balance may be considered a taxable distribution.

2.5 Opportunity Cost

The money you put into a cash value life insurance policy could be used for other investments with potentially higher returns; this opportunity cost should be considered when evaluating the policy’s overall value.

Opportunity cost is a significant factor when considering cash value life insurance; alternative investments may offer better returns.

2.6 Conflicts of Interest

Insurance agents may have a conflict of interest when selling cash value life insurance, as they often earn higher commissions on these policies compared to term life insurance; this can lead to biased advice and recommendations.

Conflicts of interest can influence the sale of cash value life insurance; seeking unbiased advice is essential.

3. Alternatives to Cash Value Life Insurance

If cash value life insurance isn’t the best fit for your financial goals, several alternatives can provide better value and flexibility; these include term life insurance combined with other investment options.

Exploring alternatives to cash value life insurance can lead to more efficient and effective financial planning.

3.1 Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, and is typically much more affordable than cash value life insurance; it’s a straightforward way to protect your family’s financial future in case of your death.

Term life insurance offers affordable coverage for a specific period; it is a cost-effective alternative to cash value policies.

- Lower Premiums: Term life insurance premiums are significantly lower than those for cash value policies, allowing you to allocate more money to other investments.

- Simple and Transparent: Term life insurance is easy to understand, with no hidden fees or complex terms.

- Flexibility: You can choose the coverage amount and term length that best suit your needs, and you can renew or convert the policy at the end of the term.

3.2 Investing in Retirement Accounts

Retirement accounts such as 401(k)s and IRAs offer tax advantages and the potential for higher returns compared to the cash value component of life insurance; these accounts can be a more efficient way to save for retirement.

Retirement accounts provide tax advantages and potentially higher returns; they are a smart alternative to cash value savings.

- 401(k)s: Employer-sponsored retirement plans that offer tax-deferred growth and potential employer matching contributions.

- Traditional IRAs: Allow you to deduct contributions from your taxes and defer taxes on the growth until retirement.

- Roth IRAs: Offer tax-free withdrawals in retirement, as contributions are made with after-tax dollars.

3.3 Investing in Stocks, Bonds, and Mutual Funds

Investing in a diversified portfolio of stocks, bonds, and mutual funds can provide higher returns than the cash value component of life insurance; this approach requires more active management but can be more rewarding in the long run.

Investing in stocks, bonds, and mutual funds can yield higher returns; diversification is key to managing risk.

- Stocks: Offer the potential for high growth but also come with higher risk.

- Bonds: Provide a more stable return and are generally less risky than stocks.

- Mutual Funds: Offer diversification by investing in a mix of stocks, bonds, and other assets.

3.4 Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged accounts that can be used to pay for medical expenses; they offer a triple tax benefit: tax-deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses.

HSAs offer a triple tax benefit and can be a valuable tool for healthcare savings.

4. When Might Cash Value Life Insurance Be Suitable?

Despite its drawbacks, cash value life insurance may be suitable for certain individuals with specific financial goals and circumstances; understanding these situations can help you determine if it’s the right choice for you.

Cash value life insurance can be a suitable choice in specific situations; understanding these scenarios is essential.

4.1 Estate Planning

Cash value life insurance can be a useful tool for estate planning, providing a way to pass wealth to heirs while avoiding estate taxes; the death benefit can be used to cover estate taxes or provide liquidity to the estate.

Estate planning is a key benefit of cash value life insurance; it can help preserve wealth for future generations.

4.2 High-Income Earners

High-income earners who have already maxed out other tax-advantaged retirement accounts may find cash value life insurance appealing as a way to save more on a tax-deferred basis; it can provide an additional layer of tax-advantaged savings.

High-income earners may benefit from the tax-deferred growth offered by cash value life insurance.

4.3 Charitable Giving

Cash value life insurance can be used as a tool for charitable giving, allowing you to donate the death benefit to a charity while receiving a tax deduction; this can be a meaningful way to support your favorite causes.

Charitable giving can be facilitated through cash value life insurance; it offers a way to support causes you care about.

5. Making an Informed Decision

Choosing the right type of life insurance and investment strategy requires careful consideration of your financial goals, risk tolerance, and time horizon; consulting with a financial advisor can help you make an informed decision.

Making an informed decision about cash value life insurance requires careful consideration; consulting with a financial advisor is highly recommended.

5.1 Assess Your Financial Goals

Before purchasing any life insurance policy, it’s essential to assess your financial goals and determine what you want to achieve; this includes identifying your insurance needs, retirement savings goals, and investment objectives.

Assessing your financial goals is the first step in choosing the right insurance and investment strategy.

5.2 Compare Different Policies

If you’re considering cash value life insurance, compare different policies from multiple insurance companies to find the best rates and terms; pay attention to the fees, charges, and potential returns of each policy.

Comparing different policies is crucial for finding the best value in cash value life insurance.

5.3 Seek Professional Advice

Consulting with a financial advisor can provide valuable insights and guidance in choosing the right life insurance and investment strategy; a financial advisor can help you assess your needs, compare different options, and make informed decisions.

Seeking professional advice can help you navigate the complexities of cash value life insurance.

6. Understanding the Fine Print

Navigating the complexities of cash value life insurance requires a keen understanding of policy terms and potential pitfalls; transparency is key.

Delving into the fine print of cash value life insurance can reveal potential drawbacks; understanding policy terms is essential.

6.1 Reading Policy Documents

Take the time to thoroughly read and understand the policy documents before making a purchase; pay attention to the fees, charges, surrender charges, and other terms that could impact the value of the policy.

Reading policy documents carefully can prevent misunderstandings and financial surprises.

6.2 Understanding Surrender Charges

Surrender charges can significantly reduce the amount of cash value you receive if you cancel the policy early; be aware of the surrender charge schedule and how it affects your policy’s value.

Understanding surrender charges is crucial for assessing the liquidity of cash value life insurance.

6.3 Reviewing Policy Illustrations

Policy illustrations provide projections of the policy’s future performance, but these are not guaranteed; review the illustrations carefully and understand the assumptions behind them.

Reviewing policy illustrations can provide insights into potential performance, but projections are not guaranteed.

7. Case Studies: Real-Life Examples

Examining real-life examples can provide valuable insights into the potential benefits and drawbacks of cash value life insurance; consider these scenarios to better understand how these policies work in practice.

Real-life examples can illustrate the potential outcomes of cash value life insurance.

7.1 Case Study 1: The Young Professional

A young professional purchases a cash value life insurance policy with the goal of saving for retirement; however, they find that the returns are lower than expected and the fees are higher than anticipated, leading them to switch to a term life insurance policy and invest the difference in a diversified portfolio of stocks and bonds.

A young professional may find better returns through term life insurance and diversified investments.

7.2 Case Study 2: The High-Income Earner

A high-income earner purchases a cash value life insurance policy as an additional tax-advantaged savings vehicle; they have already maxed out their 401(k) and IRA contributions and are looking for other ways to save on a tax-deferred basis; in this case, the cash value life insurance policy may be a suitable option.

A high-income earner may benefit from the tax advantages of cash value life insurance when other options are exhausted.

7.3 Case Study 3: The Estate Planner

An individual uses cash value life insurance as part of their estate plan to pass wealth to their heirs while avoiding estate taxes; the death benefit is used to cover estate taxes and provide liquidity to the estate, making it a valuable tool for wealth preservation.

Estate planning can be effectively managed using cash value life insurance to preserve wealth for future generations.

8. Recent Trends in the Life Insurance Market

Staying informed about recent trends in the life insurance market can help you make more informed decisions about your coverage; these trends include the rise of online insurance platforms, the increasing popularity of term life insurance, and the growing demand for personalized financial advice.

Recent trends in the life insurance market can influence your decisions about coverage.

8.1 Rise of Online Insurance Platforms

Online insurance platforms are making it easier to compare different policies and get quotes from multiple insurance companies; this increased transparency and competition can lead to lower prices and better terms for consumers.

Online insurance platforms are increasing transparency and competition in the life insurance market.

8.2 Increasing Popularity of Term Life Insurance

Term life insurance is becoming increasingly popular due to its affordability and simplicity; many consumers are realizing that they can get the coverage they need at a much lower cost compared to cash value life insurance.

Term life insurance is gaining popularity due to its affordability and straightforward nature.

8.3 Demand for Personalized Financial Advice

There is a growing demand for personalized financial advice as consumers seek guidance in navigating the complexities of the life insurance and investment markets; financial advisors can provide valuable insights and help you make informed decisions that align with your financial goals.

Personalized financial advice is increasingly valuable in navigating the complexities of insurance and investment decisions.

9. Expert Opinions on Cash Value Life Insurance

Gaining insights from financial experts can provide a balanced perspective on the advantages and disadvantages of cash value life insurance; their expertise can help you make a more informed decision based on your unique circumstances.

Expert opinions can offer valuable insights into the pros and cons of cash value life insurance.

9.1 Financial Advisors’ Perspectives

Financial advisors often caution against using cash value life insurance as a primary investment vehicle, recommending it only in specific situations such as estate planning or for high-income earners who have maxed out other retirement accounts; they emphasize the importance of considering the high costs and lower returns compared to other investment options.

Financial advisors recommend caution when considering cash value life insurance as an investment.

9.2 Insurance Industry Insights

The insurance industry highlights the benefits of cash value life insurance, such as lifelong coverage, tax-deferred growth, and the ability to borrow against the cash value; however, they also acknowledge the importance of understanding the policy terms and fees.

The insurance industry emphasizes the benefits of lifelong coverage and tax-deferred growth in cash value policies.

10. Frequently Asked Questions (FAQs)

Addressing frequently asked questions can clarify common misconceptions and provide additional insights into cash value life insurance; understanding these FAQs can help you make a more informed decision.

Addressing frequently asked questions can help clarify the complexities of cash value life insurance.

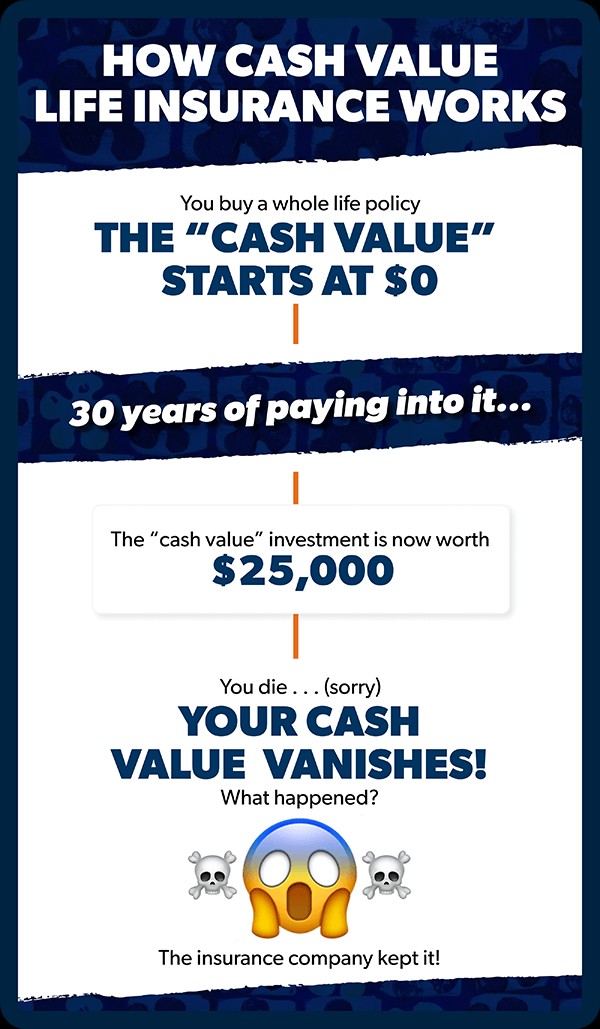

10.1 What Happens to the Cash Value When I Die?

Typically, the cash value reverts to the insurance company upon your death; however, some policies allow you to designate a beneficiary to receive the cash value in addition to the death benefit.

The cash value often reverts to the insurance company upon death, unless otherwise specified in the policy.

10.2 Can I Withdraw Money From My Cash Value Life Insurance Policy?

Yes, you can withdraw money from your cash value life insurance policy, but withdrawals may be subject to taxes and could reduce the death benefit; also, consider potential surrender charges.

Withdrawals from cash value life insurance are possible but may have tax implications and reduce the death benefit.

10.3 Is Cash Value Life Insurance a Good Way to Save for Retirement?

Generally, no; cash value life insurance is not the most efficient way to save for retirement due to its high costs and lower returns compared to other investment options like 401(k)s and IRAs.

Cash value life insurance is generally not recommended as a primary retirement savings vehicle.

10.4 What Is the Difference Between Whole Life and Term Life Insurance?

Whole life insurance provides lifelong coverage and includes a cash value component, while term life insurance provides coverage for a specific period and does not have a cash value; term life insurance is typically much more affordable.

Whole life offers lifelong coverage with a cash value, while term life provides coverage for a specific period without a cash value.

10.5 How Can I Find the Best Life Insurance Policy for My Needs?

To find the best life insurance policy for your needs, assess your financial goals, compare different policies from multiple insurance companies, and consult with a financial advisor; consider factors such as coverage amount, term length, premiums, and fees.

Finding the best life insurance policy requires assessing your needs, comparing options, and seeking professional advice.

10.6 Are Policy Loans Tax-Free?

Yes, generally, loans against the cash value of your life insurance policy are tax-free, but if the policy lapses or is surrendered, the outstanding loan balance may be considered a taxable distribution.

Policy loans are typically tax-free, but the tax implications can change if the policy lapses or is surrendered.

10.7 What Are the Tax Advantages of Cash Value Life Insurance?

Cash value life insurance offers tax-deferred growth, meaning you don’t pay taxes on the growth until you withdraw the money; also, death benefits are generally tax-free to the beneficiary.

Tax-deferred growth and tax-free death benefits are key tax advantages of cash value life insurance.

10.8 What Should I Consider Before Surrendering My Policy?

Before surrendering your policy, consider the surrender charges, tax implications, and loss of life insurance coverage; evaluate whether the benefits of surrendering the policy outweigh the costs.

Consider surrender charges, tax implications, and loss of coverage before surrendering a cash value policy.

10.9 How Does Inflation Impact Cash Value Life Insurance?

Inflation can erode the real value of the cash value and death benefit over time; it’s important to consider inflation when evaluating the long-term benefits of the policy.

Inflation can erode the real value of cash value life insurance over time.

10.10 Can I Use Cash Value Life Insurance for Long-Term Care Expenses?

Some cash value life insurance policies offer riders that allow you to use the cash value to pay for long-term care expenses; however, these riders may come with additional costs and restrictions.

Some cash value policies offer riders for long-term care expenses, but these may come with additional costs and restrictions.

11. Conclusion: Is Cash Value Life Insurance Right for You?

Deciding whether cash value life insurance is right for you requires a thorough understanding of its features, costs, and potential benefits, as well as careful consideration of your financial goals and alternatives; remember that at WHY.EDU.VN, we want you to be well-informed. While it may be suitable for certain individuals, it’s essential to weigh the pros and cons and seek professional advice before making a decision.

Choosing between cash value and term life insurance hinges on individual financial goals; understanding the difference is key.

Remember, the decision to invest in cash value life insurance should align with your broader financial strategy. If you’re unsure whether it’s the right choice for you, seek guidance from a financial advisor who can help you evaluate your options and make informed decisions. And for more information and expert advice, visit WHY.EDU.VN, your trusted resource for financial literacy.

Are you still unsure about whether cash value life insurance is the right choice for you? Do you have more questions about life insurance or other financial topics? Don’t hesitate to reach out to the experts at WHY.EDU.VN for personalized guidance. You can visit us at 101 Curiosity Lane, Answer Town, CA 90210, United States, or contact us via WhatsApp at +1 (213) 555-0101. Our website, why.edu.vn, is also a great resource for finding answers to your most pressing questions. Let us help you navigate the complexities of financial planning and make informed decisions that will secure your future!

Cash value versus term life insurance

Cash value versus term life insurance