The Great Depression occurred due to a complex interplay of factors, including the stock market crash, banking panics, adherence to the gold standard, and decreased international lending. At WHY.EDU.VN, we provide detailed explanations and expert insights into this historical event. Understanding the depression requires examining the monetary policy, trade policies, and global economic conditions that converged to create this crisis, alongside exploring its long-term effects and lessons.

1. What Were the Primary Causes of the Great Depression?

The Great Depression, a period of severe economic decline that lasted from 1929 to 1939, was triggered by a combination of factors that created a perfect storm of economic hardship.

- Stock Market Crash of 1929

- Banking Panics and Monetary Contraction

- The Gold Standard

- Decreased International Lending and Tariffs

1.1 The Stock Market Crash of 1929

The roaring twenties saw an unprecedented surge in the U.S. stock market, with stock prices reaching record highs. Investing became a popular way to make money, and many people, even those with limited resources, invested their disposable income or mortgaged their homes to buy stock. The widespread use of margin loans, where investors borrowed money to finance stock purchases, amplified the market’s volatility. When stock prices inevitably began to fall in October 1929, panic ensued, and investors rushed to sell their holdings, causing prices to plummet further. Between September and November, stock prices fell by 33%. This crash had a profound psychological impact, eroding consumer and business confidence. Consequently, consumer spending, especially on durable goods, and business investment declined sharply, leading to reduced industrial output and job losses. This decline in spending and investment further exacerbated the economic downturn.

| Factor | Description |

|---|---|

| Stock Market Expansion | Stock prices rose to unprecedented levels during the 1920s. |

| Margin Loans | Investors borrowed money to buy stocks, amplifying market volatility. |

| Panic Selling | When stock prices declined, investors rushed to sell, causing prices to plummet. |

| Erosion of Confidence | The crash eroded consumer and business confidence, leading to reduced spending and investment. |

| Decline in Industrial Output | Reduced spending and investment led to decreased production and job losses, further worsening the economic downturn. |

1.2 Banking Panics and Monetary Contraction

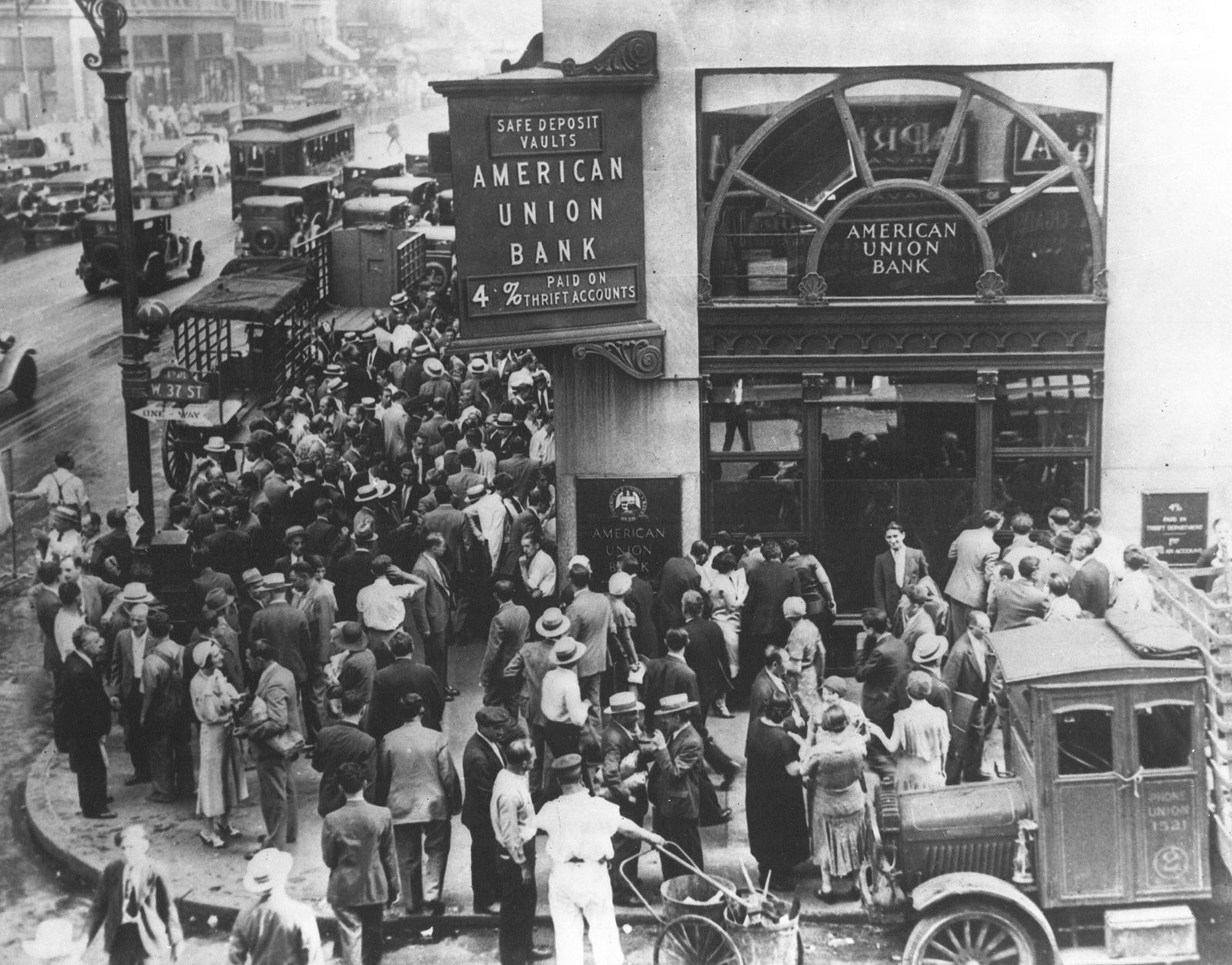

Between 1930 and 1932, the United States experienced a series of banking panics. Customers, fearing the solvency of their banks, rushed to withdraw their deposits. These panics often led to the very crises they were meant to avoid, as even healthy banks could be ruined by a large number of withdrawals. By 1933, one-fifth of the banks in existence in 1930 had failed. In response, the Franklin D. Roosevelt administration declared a “bank holiday,” closing all banks until they could prove their solvency to government inspectors. Widespread bank failures decreased consumer spending and business investment, as there were fewer banks to lend money. The money supply also decreased as people hoarded cash. Some scholars argue that the Federal Reserve exacerbated the problem by raising interest rates and deliberately reducing the money supply to maintain the gold standard. This reduction in the money supply led to lower prices, further discouraging lending and investment as people feared that future wages and profits would not be sufficient to cover loan payments.

| Factor | Description |

|---|---|

| Banking Panics | Customers, fearing bank solvency, rushed to withdraw deposits, causing bank failures. |

| Bank Holiday | The Roosevelt administration closed banks until they could prove their solvency. |

| Decreased Lending | Bank failures reduced the availability of loans, decreasing consumer spending and business investment. |

| Reduced Money Supply | People hoarded cash, and the Federal Reserve reduced the money supply to maintain the gold standard. |

| Lower Prices | The reduced money supply led to lower prices, discouraging lending and investment. |

1.3 The Gold Standard

The gold standard, which tied the value of currencies to a fixed amount of gold, played a significant role in spreading the Great Depression from the United States to other countries. As the U.S. experienced declining output and deflation, it tended to run a trade surplus with other countries, as Americans bought fewer imported goods and American exports were relatively cheap. This imbalance led to significant foreign gold outflows to the United States, threatening to devalue the currencies of countries whose gold reserves had been depleted. Foreign central banks attempted to counteract the trade imbalance by raising their interest rates, which reduced output and prices and increased unemployment in their countries. The resulting international economic decline, especially in Europe, was nearly as severe as that in the United States.

| Factor | Description |

|---|---|

| Currency Value | The gold standard tied the value of currencies to a fixed amount of gold. |

| Trade Surplus | The U.S. experienced a trade surplus due to declining output and deflation. |

| Gold Outflows | The trade imbalance led to foreign gold outflows to the United States, threatening to devalue other countries’ currencies. |

| Interest Rate Hikes | Foreign central banks raised interest rates to counteract the trade imbalance, reducing output, prices, and increasing unemployment. |

| International Decline | The resulting international economic decline, especially in Europe, was nearly as severe as that in the United States. |

1.4 Decreased International Lending and Tariffs

In the late 1920s, lending by U.S. banks to foreign countries decreased, partly due to relatively high U.S. interest rates. This drop-off contributed to contractionary effects in some borrower countries, particularly Germany, Argentina, and Brazil, whose economies entered a downturn even before the beginning of the Great Depression in the United States. American agricultural interests, suffering from overproduction and increased competition, lobbied Congress for new tariffs on agricultural imports. Congress passed the Smoot-Hawley Tariff Act (1930), which imposed steep tariffs (averaging 20 percent) on a wide range of agricultural and industrial products. This legislation provoked retaliatory measures by other countries, leading to declining output in several countries and a reduction in global trade.

| Factor | Description |

|---|---|

| Decreased Lending | Lending by U.S. banks to foreign countries decreased, contributing to economic downturns in borrower countries. |

| Smoot-Hawley Tariff Act | Imposed steep tariffs on a wide range of agricultural and industrial products. |

| Retaliatory Measures | Other countries retaliated with their own tariffs, leading to declining output and a reduction in global trade. |

Image alt: Desperate depositors gather outside the closed American Union Bank in New York City during a bank run in April 1932, highlighting the panic and financial instability of the Great Depression era.

2. How Did the Stock Market Crash Contribute to the Great Depression?

The stock market crash of 1929 is often seen as the starting point of the Great Depression, but it wasn’t the sole cause. It triggered a chain reaction that exposed underlying weaknesses in the economy. The rapid increase in stock values during the 1920s, known as the “Roaring Twenties,” was fueled by speculative investment. Many people bought stocks on margin, meaning they borrowed money to purchase them, hoping to profit from rising prices. When the market began to decline, these investors were forced to sell their stocks to cover their debts, leading to a massive sell-off that caused prices to plummet.

2.1 The Role of Speculation and Margin Buying

Speculation and margin buying amplified the effects of the crash. As stock prices rose, people became more willing to take risks, believing that the market would continue to climb indefinitely. This led to a bubble, where stock prices were inflated beyond their actual value. Margin buying allowed investors to purchase more stock than they could afford, further fueling the bubble. When the market turned downward, these investors were forced to sell their holdings at a loss, exacerbating the decline.

2.2 Impact on Consumer Confidence and Spending

The stock market crash had a devastating impact on consumer confidence and spending. As people lost their savings in the market, they became more cautious about spending money. This decline in consumer spending led to reduced demand for goods and services, causing businesses to cut production and lay off workers. The resulting unemployment further reduced consumer spending, creating a vicious cycle of economic decline.

2.3 Effect on Business Investment

The crash also had a negative impact on business investment. As consumer demand declined, businesses became less willing to invest in new equipment and factories. This led to a further reduction in economic activity and job losses. The combination of reduced consumer spending and business investment created a deep and prolonged economic downturn.

3. What Role Did Banking Failures Play in the Great Depression?

Banking failures were a significant factor in the Great Depression. In the years following the stock market crash, many banks failed as depositors lost confidence in the banking system and rushed to withdraw their funds. These “bank runs” depleted banks’ reserves and forced them to close. The failure of banks had a ripple effect throughout the economy.

3.1 The Impact of Bank Runs

Bank runs were devastating to the banking system. As depositors rushed to withdraw their funds, banks were forced to sell their assets to meet the demand. This often meant selling assets at a loss, further weakening the banks’ financial position. The failure of one bank could trigger a run on other banks, leading to a domino effect of bank failures.

3.2 Contraction of Credit and Lending

The failure of banks led to a contraction of credit and lending. As banks closed, they stopped making loans to businesses and consumers. This made it difficult for businesses to finance their operations and for consumers to make purchases. The resulting decline in economic activity further exacerbated the depression.

3.3 Loss of Savings and Consumer Spending

Bank failures also led to a loss of savings and consumer spending. As banks closed, depositors lost their savings, reducing their ability to spend money. This further reduced demand for goods and services, causing businesses to cut production and lay off workers.

4. How Did International Trade Policies Contribute to the Great Depression?

International trade policies also played a role in the Great Depression. In an attempt to protect domestic industries, the United States and other countries imposed high tariffs on imported goods. These tariffs backfired, leading to a decline in international trade and further economic hardship.

4.1 The Smoot-Hawley Tariff Act

The Smoot-Hawley Tariff Act, passed in 1930, was one of the most significant trade policies of the Great Depression era. The act raised tariffs on thousands of imported goods, with the goal of protecting American industries from foreign competition. However, other countries retaliated by raising their own tariffs, leading to a sharp decline in international trade.

4.2 Impact on Global Trade and Economic Activity

The decline in international trade had a negative impact on global economic activity. As countries imposed tariffs on each other’s goods, trade slowed down, and businesses that relied on exports suffered. This led to reduced production, job losses, and further economic decline.

4.3 Effects on Agricultural Producers

Agricultural producers were particularly hard hit by the decline in international trade. As tariffs rose, foreign countries reduced their imports of American agricultural products. This led to a surplus of agricultural goods in the United States, driving down prices and hurting farmers.

5. What Was the Role of the Gold Standard in the Great Depression?

The gold standard, a monetary system in which the value of a country’s currency is directly linked to a fixed quantity of gold, is often cited as a contributing factor to the Great Depression. While the gold standard had been in place for many years, its rigidities and constraints exacerbated the economic downturn.

5.1 How the Gold Standard Worked

Under the gold standard, countries agreed to convert their currency into gold at a fixed rate. This meant that the amount of money in circulation was limited by the amount of gold a country held. The gold standard was intended to promote price stability and prevent inflation, but it also limited the ability of governments to respond to economic shocks.

5.2 Constraints on Monetary Policy

The gold standard constrained monetary policy. Because the amount of money in circulation was tied to the amount of gold a country held, governments could not easily increase the money supply to stimulate the economy during a recession. This limited their ability to lower interest rates and encourage borrowing and investment.

5.3 Transmission of Economic Shocks

The gold standard also transmitted economic shocks between countries. If one country experienced an economic downturn, it could lead to a decline in demand for goods and services from other countries. This decline in demand could then spread to other countries through the gold standard, as countries with trade deficits were forced to reduce their money supply to maintain the value of their currency.

6. How Did Decreased International Lending Affect the Great Depression?

Decreased international lending also contributed to the Great Depression. In the years leading up to the depression, the United States had been a major lender to other countries, particularly in Europe. However, as the U.S. economy began to slow down, American banks became less willing to lend money abroad.

6.1 Decline in U.S. Lending to Europe

The decline in U.S. lending to Europe had a significant impact on the European economy. Many European countries had become dependent on American loans to finance their recovery from World War I. As these loans dried up, European economies began to slow down, leading to reduced demand for American goods and services.

6.2 Impact on European Economies

The impact on European economies was significant. European countries had become dependent on American loans to finance their recovery from World War I. As these loans dried up, European economies began to slow down, leading to reduced demand for American goods and services.

6.3 Effects on Global Economic Activity

The decline in international lending had a negative impact on global economic activity. As countries reduced their borrowing and lending, trade slowed down, and businesses that relied on international finance suffered. This led to reduced production, job losses, and further economic decline.

7. What Were the Social and Human Costs of the Great Depression?

The Great Depression had devastating social and human costs. Millions of people lost their jobs, homes, and savings. Poverty and homelessness soared, and many families struggled to survive. The depression also had a profound psychological impact, leading to increased stress, anxiety, and depression.

7.1 Unemployment and Poverty

Unemployment and poverty were widespread during the Great Depression. At the height of the depression, unemployment rates reached as high as 25 percent. Many people who lost their jobs also lost their homes and savings, leaving them destitute.

7.2 Homelessness and Migration

Homelessness and migration also increased during the Great Depression. Many people who lost their homes were forced to live on the streets or in makeshift shelters. Others migrated to other parts of the country in search of work, often finding little relief.

7.3 Psychological Impact

The Great Depression had a profound psychological impact on people. The stress and anxiety of losing a job, home, or savings took a toll on people’s mental health. Suicide rates increased during the depression, and many people suffered from depression and other mental health problems.

8. How Did the New Deal Attempt to Address the Great Depression?

The New Deal, a series of programs and policies enacted by President Franklin D. Roosevelt in the 1930s, was an attempt to address the Great Depression. The New Deal aimed to provide relief to the unemployed, stimulate economic recovery, and reform the financial system.

8.1 Relief, Recovery, and Reform

The New Deal was based on three main goals: relief, recovery, and reform. Relief programs were designed to provide immediate assistance to the unemployed and those in need. Recovery programs aimed to stimulate economic growth and create jobs. Reform programs sought to prevent future economic crises by reforming the financial system and addressing the underlying causes of the depression.

8.2 Key Programs and Initiatives

The New Deal included a wide range of programs and initiatives. Some of the most important included the Civilian Conservation Corps (CCC), which provided jobs for young men in conservation projects; the Public Works Administration (PWA), which funded the construction of public works projects; and the Social Security Act, which established a system of old-age pensions and unemployment insurance.

8.3 Impact and Effectiveness

The New Deal had a significant impact on the United States. The New Deal provided relief to millions of unemployed and those in need. New Deal programs helped to stimulate economic recovery and create jobs. The New Deal also reformed the financial system and addressed some of the underlying causes of the depression. However, the New Deal did not completely end the Great Depression. It was not until the onset of World War II that the U.S. economy fully recovered.

9. What Lessons Can We Learn from the Great Depression?

The Great Depression offers several important lessons for policymakers and economists. These lessons relate to the importance of financial regulation, the role of government in managing the economy, and the need for international cooperation.

9.1 Importance of Financial Regulation

The Great Depression highlighted the importance of financial regulation. The lack of regulation in the 1920s allowed for excessive speculation and risk-taking in the stock market and banking system. This contributed to the stock market crash and the subsequent banking failures.

9.2 Role of Government in Managing the Economy

The Great Depression also demonstrated the role of government in managing the economy. Before the New Deal, the prevailing view was that the government should not interfere in the economy. However, the Great Depression showed that government intervention was necessary to provide relief to the unemployed, stimulate economic recovery, and prevent future economic crises.

9.3 Need for International Cooperation

The Great Depression also underscored the need for international cooperation. The Smoot-Hawley Tariff Act and other protectionist trade policies exacerbated the depression by reducing international trade. International cooperation is essential for managing the global economy and preventing future economic crises.

10. What Were the Long-Term Effects of the Great Depression?

The Great Depression had long-term effects on the United States and the world. These effects include changes in the role of government, the development of the welfare state, and shifts in economic thinking.

10.1 Changes in the Role of Government

The Great Depression led to significant changes in the role of government in the United States. The New Deal expanded the role of government in the economy and established the principle that the government has a responsibility to provide for the welfare of its citizens.

10.2 Development of the Welfare State

The Great Depression also led to the development of the welfare state. The Social Security Act and other New Deal programs established a system of social insurance and public assistance that provides a safety net for the unemployed, the elderly, and the poor.

10.3 Shifts in Economic Thinking

The Great Depression also led to shifts in economic thinking. Before the depression, the prevailing view was that the economy was self-regulating and that government intervention was unnecessary. However, the depression showed that the economy was not always self-regulating and that government intervention could be necessary to stabilize the economy and prevent future crises.

| Aspect | Pre-Depression View | Post-Depression View |

|---|---|---|

| Role of Government | Limited intervention; economy is self-regulating. | Active intervention to stabilize the economy and provide welfare. |

| Financial Regulation | Minimal regulation; free markets promote efficiency. | Strong regulation to prevent speculation and risk-taking. |

| Social Safety Net | Limited; individual responsibility for welfare. | Expanded; government responsibility to provide for basic needs. |

| International Cooperation | Limited; protectionist policies are beneficial. | Essential for managing the global economy and preventing crises. |

| Economic Thinking | Laissez-faire economics; markets are always efficient. | Keynesian economics; government intervention can stabilize markets. |

Exploring the causes, consequences, and lessons of the Great Depression provides valuable insights into economic history and policy. At WHY.EDU.VN, we strive to offer comprehensive and reliable information to help you understand complex topics.

FAQ: Understanding the Great Depression

1. What was the Great Depression?

The Great Depression was a severe worldwide economic depression that took place mostly during the 1930s, beginning in the United States.

2. When did the Great Depression start and end?

It began with the stock market crash of October 1929 and lasted until about 1939.

3. What were the main causes of the Great Depression?

The main causes included the stock market crash, banking panics, the gold standard, and decreased international lending and tariffs.

4. How did the stock market crash of 1929 contribute to the Great Depression?

The crash led to a loss of confidence, decreased consumer spending and business investment, and triggered a chain reaction of economic decline.

5. What role did banking failures play in the Great Depression?

Banking failures reduced credit availability, decreased consumer spending, and caused widespread loss of savings.

6. How did the gold standard affect the Great Depression?

The gold standard limited monetary policy flexibility and transmitted economic shocks between countries.

7. What was the Smoot-Hawley Tariff Act, and how did it impact the Great Depression?

It was an act that raised tariffs on imported goods, leading to retaliatory measures and a decline in international trade.

8. What were the social and human costs of the Great Depression?

High unemployment, poverty, homelessness, and a severe psychological impact on individuals and families.

9. What was the New Deal, and how did it attempt to address the Great Depression?

The New Deal was a series of programs and policies enacted by President Franklin D. Roosevelt to provide relief, stimulate economic recovery, and reform the financial system.

10. What are some lessons we can learn from the Great Depression?

The importance of financial regulation, the role of government in managing the economy, and the need for international cooperation.

Do you have more questions about the Great Depression or other historical events? Visit WHY.EDU.VN to ask your questions and receive answers from our team of experts. We are dedicated to providing clear, accurate, and comprehensive information to satisfy your curiosity.

Contact Us:

Address: 101 Curiosity Lane, Answer Town, CA 90210, United States

WhatsApp: +1 (213) 555-0101

Website: why.edu.vn

We are here to help you find the answers you seek.