Indexed Universal Life (IUL) insurance policies often appear to be a compelling financial product, promising a blend of investment growth, robust guarantees, and attractive tax advantages. On the surface, it sounds like you can have your cake and eat it too. However, digging deeper reveals a different story. As someone who actually purchased an Indexed Universal Life policy myself, I can tell you firsthand that the reality rarely lives up to the initial sales pitch. After carefully reviewing the policy details and doing the necessary calculations, I uncovered some uncomfortable truths. This comprehensive guide will expose the common misrepresentations made by IUL agents and explain precisely Why Iul Is A Bad Investment for the vast majority of people seeking to build long-term wealth and secure their financial future. If you’re considering an IUL or have been approached by an agent promoting one, it’s crucial to understand the potential pitfalls before making a decision that could significantly impact your financial well-being.

Understanding How Indexed Universal Life Insurance (IUL) Operates

Indexed Universal Life (IUL) insurance is categorized as permanent life insurance, meaning it’s designed to provide coverage for your entire life, unlike term life insurance which covers a specific period. IUL policies combine this life insurance component with a cash value savings element that is linked to the performance of a market index, typically the S&P 500.

When you pay premiums for an IUL policy, a portion goes towards covering the death benefit – the payout your beneficiaries receive upon your passing. The remainder is allocated to a cash value account, which is where the “investment” aspect comes in. This cash value is not directly invested in the stock market. Instead, its growth is tied to the returns of a chosen market index. When the index performs well, your cash value can potentially increase, subject to certain limitations.

A key selling point of IUL policies is the perceived benefits, often highlighted by insurance agents:

- Downside Protection: A “floor” that limits losses during market downturns, suggesting your cash value is safe from significant market drops.

- Upside Potential: The opportunity to participate in market gains, allowing your cash value to grow along with the chosen index.

- Tax Advantages: Tax-deferred growth within the policy and the potential for tax-free withdrawals and a tax-free death benefit.

- “Be Your Own Bank”: The ability to borrow against your policy’s cash value, giving you access to funds when needed.

While these features sound appealing, it’s essential to recognize that the reality of IUL policies is often more complex and less advantageous than these simplified selling points suggest. The gains in your cash value account are not a direct reflection of market performance. They are typically limited by factors such as participation rates, interest rate caps, or a combination of both. These limitations can significantly restrict the growth potential of your cash value compared to simply investing directly in the market through low-cost index funds.

While IUL policies offer some flexibility in premium payments and potential market participation, they are inherently complex and carry numerous disadvantages. Before considering an IUL, it’s imperative to thoroughly understand the policy’s intricate terms and conditions. These policies can be particularly unsuitable for individuals who are not well-versed in financial instruments and are seeking straightforward, efficient ways to invest for retirement or other long-term financial goals.

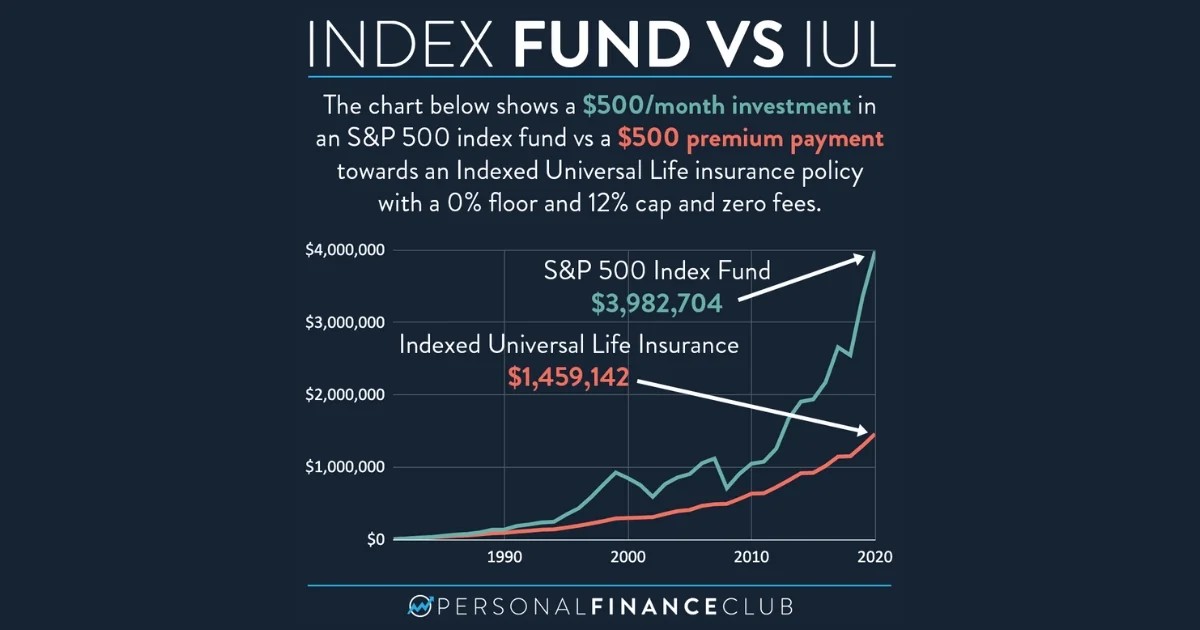

Chart showing why an IUL is a bad investment by highlighting that a low-cost S&P 500 index fund outperformed an Indexed Universal Life (IUL) policy by over 100% since 1980.

Chart showing why an IUL is a bad investment by highlighting that a low-cost S&P 500 index fund outperformed an Indexed Universal Life (IUL) policy by over 100% since 1980.

The Intricate Nature of IUL Policies: Unveiling the Hidden Details

Indexed Universal Life Insurance (IUL) policies are frequently presented as straightforward investment tools. However, this couldn’t be further from the truth. These policies are laden with complexity, featuring a dense web of terms and conditions that can be challenging, even for financially savvy individuals, to fully grasp.

One of the first complexities you’ll encounter upon purchasing an IUL policy is the array of fees. These charges are often not immediately transparent and can significantly erode the policy’s cash value and overall returns. Common fees associated with IULs include:

- Administrative Fees: Charges for policy administration and maintenance.

- Cost of Insurance Fees: Fees to cover the life insurance component, which increase with age.

- Premium Expense Fees: A percentage taken directly from each premium payment.

- Surrender Fees: Penalties for canceling the policy within a specified period.

Furthermore, the way your cash value grows within an IUL policy, while linked to market indexes, is not as simple as mirroring index performance. Your returns are governed by:

- Participation Rates: The percentage of the index’s gains you actually receive. For example, an 80% participation rate means if the index grows by 10%, your cash value only grows by 8%.

- Caps on Gains: A maximum limit on the percentage of index growth credited to your cash value. Even if the index performs exceptionally well, your gains are capped.

- Floors on Losses: A stated minimum return, often 0%, that protects your cash value from losing value due to index declines. While this sounds good, it also means you miss out on potential gains during years with modest index growth if the policy is designed to prioritize loss protection over maximizing gains.

These factors collectively can dramatically influence your potential returns, often in ways that are difficult to predict without advanced financial expertise and careful policy analysis. The interaction of participation rates, caps, and floors can create a situation where your returns are significantly muted compared to direct market investing.

IUL policies also boast “flexible premiums,” which might seem like an advantage. However, this flexibility can be a double-edged sword. If the policy underperforms due to market conditions or high fees, you may be required to pay substantially higher premiums to keep the policy active and prevent it from lapsing. This can create financial strain and negate the intended benefits of the policy.

Finally, the cash value component of IULs is often promoted as a tool for retirement planning. While accessing this cash value through policy loans is possible, it’s fraught with potential complications. If not meticulously managed, these loans can:

- Reduce your death benefit: Outstanding loan balances directly decrease the amount your beneficiaries receive.

- Potentially cause the policy to lapse: If the loan balance grows too large relative to the cash value, the policy could lapse, resulting in a loss of coverage and potential tax liabilities.

- Create unexpected tax liabilities: While policy loans are generally tax-free, if the policy lapses or is surrendered with an outstanding loan, the loan amount can become taxable.

Therefore, understanding how an IUL policy fits into your overall financial plan demands careful and informed consideration. The inherent complexity of these policies increases the risk of misunderstanding crucial features and overlooking critical details, ultimately leading to a less-than-optimal financial outcome.

10 Compelling Reasons Why IUL is a Poor Investment Choice

IUL insurance agents are skilled at painting a rosy picture, and I know this because I was once persuaded to purchase a policy myself! To help you learn from my experience and steer clear of making a similar mistake, here are 10 key reasons why Indexed Universal Life (IUL) is generally a bad investment for most individuals:

1. Exclusion of Dividends from Performance Calculations

A common tactic in IUL sales presentations is to compare the policy’s historical performance to the S&P 500 index. However, this comparison is often misleading because it excludes dividends from the S&P 500’s returns. Dividends are a significant component of total stock market returns, typically contributing around 2-3% annually on average.

By omitting dividends, the IUL appears to perform more competitively against the S&P 500 than it actually does. When dividends are properly factored into the equation, the S&P 500’s true historical performance is substantially higher than what an IUL policy can realistically deliver, especially after considering fees and caps.

2. Selective Use of Timeframes (“Cherry-Picked” Data)

When presenting historical performance data, insurance agents may strategically select specific time periods that make IUL policies appear more favorable. They might focus on periods characterized by high market volatility or periods where the stock market experienced downturns or low growth. This is done to emphasize the policy’s downside protection feature.

However, this selective presentation of data is misleading. Over longer, more representative time horizons that include both bull and bear markets, low-cost broad market U.S. stock index funds have consistently and significantly outperformed IUL policies. A balanced long-term view reveals the underperformance of IULs compared to traditional investment options.

3. Opaque and Excessive Hidden Fees

IUL policies are notorious for their multitude of fees, which are often downplayed or not fully disclosed during the sales process. These fees can have a significant cumulative impact on the policy’s cash value and overall returns, eroding your investment gains over time. Common hidden fees include:

- Premium Expense Charges: A percentage fee deducted from each premium payment, sometimes as high as 6% or more.

- Monthly Policy Fees: Recurring charges simply for maintaining the policy.

- Per-Unit Charges Based on Death Benefit: Fees that scale with the size of the death benefit, increasing costs as coverage grows.

- Surrender Charges: Steep penalties for early policy cancellation, often lasting for 10-15 years or longer.

- Index Account Charges: Fees embedded within the index crediting method, similar to expense ratios in mutual funds, but often less transparent.

These fees are not always clearly itemized and can be difficult to track, making it challenging to fully understand the true cost of the IUL policy and how much it’s impacting your returns.

4. Substantial and Escalating Insurance Costs

Beyond the various administrative and policy-related fees, IUL policyholders must also bear the cost of the actual life insurance coverage itself. This “cost of insurance” (COI) is not fixed; it increases as you age because the risk of mortality naturally rises. As the COI escalates over time, it increasingly drains the policy’s cash value, further hindering its growth potential.

If your primary need is life insurance, particularly permanent coverage, then accepting these rising costs might seem unavoidable within an IUL structure. However, for most people, especially those focused on wealth accumulation, the high and increasing insurance costs within an IUL make it a very inefficient investment vehicle. If you don’t genuinely need permanent life insurance, then purchasing an IUL solely for its investment features is almost certainly a misstep.

5. Consistently Underwhelming Investment Performance

Despite the enticing claims of market-like or even market-beating performance, IUL policies, in practice, typically underperform low-cost index funds over the long term. This underperformance is a direct consequence of the combination of high fees, caps that limit potential investment gains, and the inherent complexity of the policy structure.

When you invest in low-cost index funds, you primarily pay a minimal management expense ratio – a transparent and typically very low fee. With an IUL policy, you are paying not only for the investment component (subject to caps and participation rates) but also for the embedded life insurance and a range of administrative fees.

Given this added layer of costs and limitations on gains, it is not surprising that IULs consistently fail to match the returns of simpler, more direct investment approaches like investing in broad market index funds. The complexity and fee structure are inherently designed to benefit the insurance company, not necessarily the policyholder’s investment goals.

6. Overstated and Misrepresented Tax Benefits

While IUL policies do offer certain tax advantages, these benefits are frequently exaggerated and presented in a misleading manner during the sales process. For instance, the tax-free death benefit, often heavily emphasized, is not unique to IULs; it’s a standard feature of all life insurance policies, including much cheaper term life insurance.

Similarly, the ability to borrow against the policy’s cash value tax-free is often touted as a significant benefit. However, this is essentially just a loan, and like any loan, it comes with its own set of risks and potential costs. It’s not a “free lunch.” Furthermore, tax-advantaged retirement accounts like Roth IRAs and 401(k)s offer more straightforward and often more beneficial tax advantages for retirement savings without the complexities and fees of an IUL.

7. The Myth of IULs Being Favored by Wealthy Investors

Insurance agents often perpetuate the myth that wealthy individuals heavily invest in IUL policies, implying that it’s a sophisticated wealth-building strategy endorsed by the affluent. However, this is largely untrue. The vast majority of wealthy individuals build and maintain their wealth through business ownership, real estate investments, and diversified portfolios of stocks and bonds, often utilizing low-cost index funds.

While some ultra-high-net-worth individuals may use permanent life insurance, including IULs, it’s primarily for estate planning purposes – specifically, to help their heirs manage large estate tax liabilities upon their passing. This is a very niche application. Unless your estate is projected to be worth significantly more than the federal estate tax exemption limit (which is currently very high, millions of dollars per individual and double for married couples), permanent insurance like IUL is generally unnecessary for tax planning purposes.

8. The Fallacy of “Infinite Banking”

The concept of “being your own bank” by borrowing against your IUL policy is a popular sales tactic, suggesting you can access your cash value for any purpose while your money continues to grow. However, this “infinite banking” strategy is fundamentally flawed and misleading. Borrowing against your IUL is still taking out a loan, even if it’s from your own policy. It involves fees and risks, and crucially, the underlying cash value in an IUL typically grows much slower than a well-diversified traditional investment portfolio.

The true path to “being your own bank” is far simpler and more effective: make more money, save diligently, and prioritize building a robust emergency fund and a sound investment portfolio. By establishing a healthy financial foundation and accumulating a substantial cash reserve, you’ll have readily accessible funds to draw upon whenever needed, without the complexities and costs associated with IUL policy loans.

9. The “You’re Just Doing It Wrong” Defense

When confronted with criticism or evidence of IUL underperformance, some insurance agents resort to the argument that the policy wasn’t “properly structured” or that the policyholder isn’t using it correctly. However, the fundamental problems with IULs – high fees, caps on gains, complexity, and the inherent conflict of combining insurance and investment – remain regardless of how the policy is structured.

An IUL policy is essentially a bundled product, attempting to combine the benefits of permanent life insurance with an investment vehicle. Since the vast majority of people do not require or benefit from permanent life insurance, the core issue isn’t how the IUL is structured, but the fact that it’s often being sold to individuals for whom it is fundamentally unsuitable. The insurance company’s role as an intermediary packaging up a complex and often unnecessary product is a central reason why IUL is a bad investment for most.

10. Additional Unfavorable and Restrictive Terms

Beyond the major drawbacks, IUL policies are often riddled with additional unfavorable terms and restrictions that are rarely highlighted during the sales process. These include:

- Withdrawal Fees: Charges for taking direct withdrawals from your cash value, as opposed to policy loans.

- Delays in Accessing Cash Value: Restrictions and waiting periods before you can fully access your cash value, especially in the early years of the policy.

- Unilateral Changes by the Insurance Company: The insurance company retains the right to change fees, participation rates, and caps at their discretion, potentially reducing the policy’s attractiveness over time.

- Loss of Cash Value Upon Death: Upon your death, the insurance company pays out the death benefit, but they retain the accumulated cash value. Your beneficiaries do not inherit the cash value in addition to the death benefit.

A Better Approach: Separate Insurance and Investing

If you have determined that you genuinely need life insurance, here’s a far more effective and financially sound strategy than purchasing an Indexed Universal Life policy:

- Calculate your actual insurance needs: Determine the appropriate amount of life insurance coverage you require to protect your family or beneficiaries.

- Purchase term life insurance: Opt for term life insurance, which is significantly more affordable than IUL policies and provides pure death benefit coverage for a specific term (e.g., 10, 20, or 30 years).

- Invest the savings: Invest the substantial amount of money you save by choosing term life insurance (instead of an expensive IUL) into low-cost, diversified index funds within tax-advantaged accounts like Roth IRAs or traditional 401(k)s.

By separating your insurance needs from your investment strategy, you can achieve better financial protection with term life insurance and build wealth more efficiently and transparently through low-cost investing. This approach provides greater control over your finances and avoids the complexities and pitfalls of IUL policies.

Essential Questions to Ask Before Considering an IUL Policy

If you are still considering an IUL policy despite the significant drawbacks, it is absolutely critical to ask your insurance agent these in-depth questions and demand clear, comprehensive answers before making any commitments:

- Premium Structure: “How are the premiums structured? Are they truly flexible, and how can they change over time? Can you provide examples of how premiums might increase under different market scenarios?”

- Index Options: “What specific stock market index options are available for cash value growth? How are these indexes chosen, and what are their historical performance characteristics?”

- Caps and Participation Rates: “What are the current cap and participation rates for this policy? Are these guaranteed for the life of the policy, or can they be changed? How frequently are they adjusted, and what factors influence these adjustments?”

- Guaranteed Interest Rate: “What is the guaranteed minimum interest rate? How does this rate compare to inflation, and what is the real rate of return after accounting for inflation over the long term?”

- Premium Payment Flexibility: “How flexible are premium payments in practice? What are the consequences of reducing or skipping premium payments? Under what circumstances could the policy lapse due to insufficient premium payments?”

- Fees and Charges (Detailed Breakdown): “Please provide a complete and itemized breakdown of all fees and charges associated with this policy, including administrative fees, mortality charges, surrender fees, premium expense charges, and any other recurring or potential fees. Show me in writing where these fees are disclosed in the policy documents.”

- Policy Loans and Withdrawals: “What are the terms and conditions for taking loans or withdrawals against the policy’s cash value? Are there any fees or interest charges associated with loans? What are the tax implications of loans and withdrawals, especially if the policy lapses or is surrendered?”

- Tax Implications (Beyond Death Benefit): “Beyond the tax-free death benefit, what are all the tax implications of this policy, including the cash value growth, loans, and withdrawals? How could this policy impact my overall tax situation in retirement or other financial planning scenarios?”

- Impact of Market and Interest Rate Changes: “How will changes in interest rates or market fluctuations affect my policy’s performance and sustainability? Can you illustrate scenarios showing how rising or falling interest rates and different market performance levels could impact my cash value growth and policy costs over the long term?”

Obtaining clear, unambiguous, and written answers to these critical questions is essential for making an informed decision about an IUL policy. If the agent is hesitant to provide detailed answers or deflects these questions, it should be a significant red flag.

Frequently Asked Questions About Indexed Universal Life (IUL)

Are there any situations where an IUL policy might be appropriate?

While extremely rare, there may be very specific and niche situations where an IUL policy could be considered, primarily for ultra-high-net-worth individuals with highly complex estate planning needs and a sophisticated understanding of financial instruments. However, even in these limited cases, the benefits are often marginal and could be achieved through more transparent and efficient means. For the vast majority – over 99.9% – of people, separating insurance and investments into distinct, simpler products is a far more effective and prudent financial strategy.

How can I tell if an insurance agent is giving me honest advice about IUL policies?

Exercise extreme caution and skepticism. Be particularly wary of agents who:

- Downplay or gloss over fees and policy complexities.

- Present overly optimistic and potentially unrealistic return projections without clearly explaining the limitations and caps.

- Pressure you to make a quick decision without allowing you sufficient time to research and seek a second opinion.

- Primarily focus on the “tax advantages” without thoroughly discussing the drawbacks and alternative options.

Always demand a full and detailed policy illustration that clearly outlines all fees, charges, and potential returns under various market scenarios. Critically, seek a second, unbiased opinion from a fee-only financial advisor – one who does not sell insurance products and is compensated solely by you for their advice.

What should I do if I already own an IUL policy?

If you currently own an IUL policy, it’s crucial to take proactive steps to understand its true performance and costs. Start by:

- Thoroughly review your policy documents: Carefully examine the policy terms, fees, surrender charges, and projected returns.

- Request an in-force illustration: Ask your insurance company for an updated policy illustration that shows the current cash value, fees paid to date, and projected future performance based on current policy parameters.

- Consult a fee-only financial advisor: Seek guidance from an independent, fee-only financial advisor who can objectively evaluate your policy in the context of your overall financial situation and goals. They can help you determine whether keeping the policy or exploring alternatives, such as surrendering it and reinvesting the cash value, would be more beneficial for your specific circumstances.

What are the typical fees associated with IUL insurance?

The fees associated with Indexed Universal Life (IUL) insurance policies can be substantial and multi-layered. They typically include, but are not limited to:

- Administration Fees: Monthly or annual charges for policy administration.

- Mortality Costs (Cost of Insurance): Fees that increase with age to cover the death benefit risk.

- Surrender Charges: Penalties for canceling the policy early.

- Premium Expense Charges: A percentage of each premium payment deducted upfront.

- Underlying Fund Expenses: Charges embedded within the index-linked investment options.

The exact fees vary depending on the specific policy, the insurance company, and policy features. The lack of fee transparency is a major concern and a significant reason why many financial experts consider IULs to be poor investment vehicles. Always demand full fee disclosure before considering an IUL.

How does IUL compare to a Roth IRA for retirement savings?

Comparing IUL to a Roth IRA highlights the fundamental difference between insurance products and investment vehicles. IUL is primarily a life insurance policy with a complex, fee-laden investment component attached. A Roth IRA, on the other hand, is a dedicated retirement savings account designed purely for investment growth.

Key differences:

- Fees: IULs have high and often opaque fees. Roth IRAs typically have very low fees, especially when investing in index funds.

- Complexity: IULs are extremely complex and difficult to understand. Roth IRAs are straightforward and transparent.

- Investment Returns: IUL returns are capped and limited by participation rates. Roth IRA returns are directly tied to the performance of your chosen investments, with no caps.

- Purpose: IUL is primarily insurance with a secondary investment feature. Roth IRA is solely for retirement savings and investment.

- Tax Advantages: Both offer tax advantages, but Roth IRAs are specifically designed for tax-advantaged retirement savings and often provide more predictable and favorable tax benefits as long as certain rules are met.

For retirement savings, a Roth IRA is almost always a superior choice to an IUL due to its lower fees, greater transparency, simplicity, and direct investment exposure.

What are some common IUL pros and cons?

Pros (Often Misrepresented or Overstated):

- Tax-deferred cash value growth (common to many investment vehicles)

- Potential for tax-free withdrawals (similar to Roth IRAs, but with more complexity and conditions)

- Permanent life insurance coverage (can be more expensive and less efficient than term life insurance for most)

- Downside protection (comes at the cost of capped upside potential and lower overall returns)

Cons (Significant and Often Understated):

- High and hidden fees

- Complex and opaque policy structure

- Limited investment potential due to caps and participation rates

- Underperformance compared to low-cost index funds

- Misleading sales tactics and exaggerated benefits

- High surrender charges and illiquidity

- Increasing cost of insurance over time

Due to the significant drawbacks, most independent financial experts and advisors strongly advise against IUL policies as investment vehicles.

Which insurance companies offer IUL investments?

Numerous insurance companies offer IUL policies. Some well-known providers include Prudential, Transamerica, Pacific Life, Allianz, and Nationwide, among others. However, it’s crucial to remember that the company offering the IUL is less important than the specific policy terms, fees, and structure. Companies may offer a wide range of IUL policies with varying features and levels of quality. Thoroughly research and compare the specifics of any IUL policy, regardless of the company offering it, before making a decision.

Can you lose money in an IUL?

While IUL policies typically include a “floor” that protects the cash value from direct market losses due to index declines, it is absolutely possible to “lose money” in an IUL in the sense that:

- Your cash value may grow very slowly or stagnate: After accounting for fees and caps, the growth in your cash value may be minimal, especially in periods of moderate market performance.

- You could lose purchasing power: If the cash value growth does not keep pace with inflation, the real value of your money decreases over time.

- Policy lapse: If you fail to pay sufficient premiums, the policy could lapse, resulting in a loss of coverage and potential tax consequences.

- Surrender charges: If you cancel the policy early, surrender charges can significantly reduce or even eliminate any cash value you’ve accumulated.

Therefore, while the “floor” prevents direct market losses, losing money in an IUL is still a real possibility when considering fees, missed investment opportunities, and potential policy complications.

How much can you invest in an IUL annually?

Unlike retirement accounts like IRAs or 401(k)s, IUL policies do not have explicit annual contribution limits set by the IRS. Instead, premiums are determined by factors such as the death benefit amount, your age, health, and policy design. However, there are practical limits. If you contribute excessively high premiums relative to the death benefit, the policy could be reclassified as a Modified Endowment Contract (MEC) by the IRS. MEC status can trigger adverse tax implications on policy loans and withdrawals, negating some of the purported tax advantages of IULs. It’s essential to consult with an insurance agent or financial advisor to ensure your IUL policy remains in a non-MEC status and to understand the implications of premium levels.

🎙️ Podcast: Why You Should Avoid Indexed Universal Life Insurance

Want to delve deeper into the reasons to avoid Indexed Universal Life Insurance (IUL) policies?

In this podcast episode, I expose the exact lies I was told when I was sold an IUL policy and share the top reasons why you should steer clear of this complex and often disadvantageous financial product. Learn from my experience and avoid making the same mistake. 👇