Why Is Xrp Dropping? XRP, also known as Ripple, has experienced significant price fluctuations, leaving investors and enthusiasts wondering about the underlying reasons. WHY.EDU.VN delves into the multiple factors influencing XRP’s price, from market trends to regulatory hurdles and technological advancements, offering clarity in the volatile world of cryptocurrency investments. Explore expert analysis, market insights, and potential future scenarios influencing the value of this digital asset and broader crypto ecosystem.

Search Intent:

- Informational: To understand the reasons behind the current drop in XRP’s price.

- Investigative: To research the factors that commonly affect XRP’s value.

- Comparative: To compare XRP’s performance against other cryptocurrencies and market trends.

- Predictive: To get insights into the potential future price movements of XRP.

- Transactional: To evaluate whether to buy, sell, or hold XRP based on the analysis.

1. Introduction to XRP and Its Market Position

XRP is a cryptocurrency designed to facilitate fast and low-cost international payments. It was created by Ripple Labs to serve as a bridge currency for financial institutions. However, the digital currency has faced several market challenges, which contribute to its price volatility. Understanding these aspects is critical for investors and observers alike.

1.1 What is XRP?

XRP is the native cryptocurrency of Ripple Labs, designed to facilitate cross-border payments. Unlike Bitcoin, which aims to be a decentralized digital currency, XRP is designed for institutional use, enabling banks and payment providers to transfer money globally with minimal fees and faster transaction times. Its technology aims to streamline international transactions, making them more efficient and cost-effective compared to traditional methods.

1.2 Historical Performance of XRP

XRP has seen significant price volatility since its inception. It experienced a substantial surge in 2017, reaching its all-time high in early 2018 before facing regulatory challenges and market corrections. The cryptocurrency’s price is influenced by overall market trends, technological advancements, and legal battles, making it essential for investors to stay informed on these factors.

1.3 XRP’s Market Capitalization and Trading Volume

XRP’s market capitalization and trading volume are essential metrics for assessing its market position and liquidity. High trading volumes indicate strong investor interest and easier execution of trades, while market capitalization reflects the overall value of all XRP tokens in circulation. Monitoring these metrics helps investors gauge the cryptocurrency’s stability and potential for future growth or decline.

2. Key Factors Influencing XRP’s Price

Several factors can influence the price of XRP, including market sentiment, regulatory news, technological developments, and competition from other cryptocurrencies. Understanding these factors is crucial for investors looking to make informed decisions.

2.1 Market Sentiment and Investor Behavior

Market sentiment plays a significant role in XRP’s price movements. Positive news, such as partnerships and technological advancements, can drive up demand and increase the price. Conversely, negative news, such as regulatory scrutiny or security breaches, can lead to panic selling and price declines. Investor behavior, including herd mentality and speculative trading, also contributes to price volatility.

2.2 Regulatory Developments and Legal Challenges

Regulatory developments and legal challenges have had a substantial impact on XRP’s price. The lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against Ripple Labs in December 2020, alleging that XRP was an unregistered security, caused significant price drops and delistings from major cryptocurrency exchanges. The ongoing legal battle continues to influence investor sentiment and market perception of XRP.

2.3 Technological Advancements and Adoption

Technological advancements and adoption rates also affect XRP’s value. Innovations that enhance XRP’s scalability, security, and functionality can increase its appeal to businesses and investors. Increased adoption by financial institutions and payment providers as a bridge currency for cross-border transactions can drive up demand and price.

2.4 Competition from Other Cryptocurrencies

The cryptocurrency market is highly competitive, with numerous altcoins vying for market share. XRP faces competition from other cryptocurrencies offering similar functionalities, such as Stellar (XLM) and stablecoins like USD Coin (USDC). The success of these competitors can draw investor attention away from XRP, impacting its price negatively.

3. Recent News and Events Affecting XRP

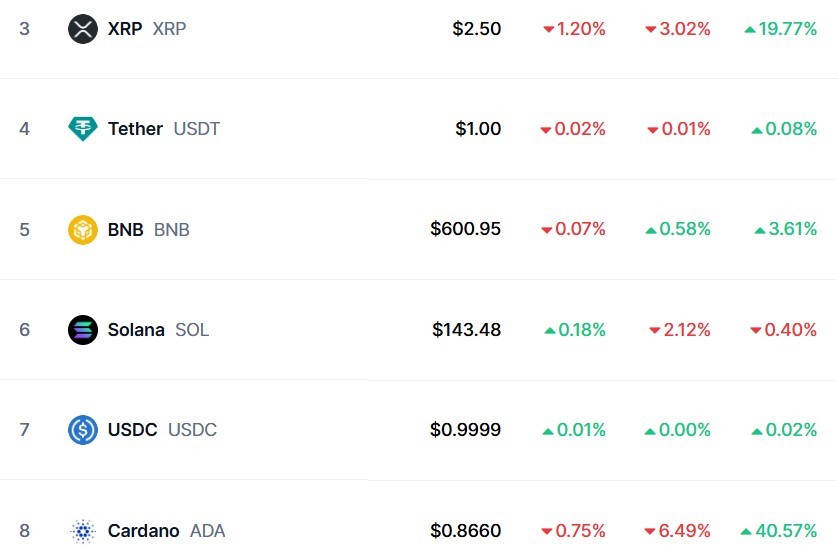

Recent news and events, such as the U.S. Presidential announcement regarding a Bitcoin Strategic Reserve and the White House Crypto Summit, have created uncertainty in the cryptocurrency market, affecting the prices of altcoins like XRP, Solana, and Cardano.

3.1 U.S. Bitcoin Strategic Reserve Announcement

The recent announcement by the U.S. President regarding a Bitcoin Strategic Reserve, which excluded major altcoins like XRP, Solana, and Cardano, led to a sharp sell-off. The market had anticipated a diversified reserve, but the focus on Bitcoin triggered disappointment among investors holding other cryptocurrencies.

3.2 White House Crypto Summit Implications

The White House Crypto Summit, scheduled for March 7, generated mixed expectations. While some market participants hoped for positive policy shifts, skepticism remained high. The summit’s outcome could either restore investor confidence or further dampen enthusiasm, depending on the regulatory signals conveyed.

3.3 Market Reactions to Trump’s Statements

Trump’s social media post initially naming Bitcoin, Ethereum, XRP, Solana, and Cardano as part of the reserve spurred market optimism. However, his later clarification that only Bitcoin would receive active government backing dampened enthusiasm. The conflicting messages contributed to market volatility and uncertainty.

3.4 Performance Comparison: XRP vs. Bitcoin

Bitcoin’s price also experienced volatility, dipping 1% from a 24-hour high of over $93,000 to around $88,000, highlighting the broader market sensitivity to regulatory news and policy changes. The performance comparison between XRP and Bitcoin reflects the differing impacts of these events on various cryptocurrencies.

4. Technical Analysis of XRP’s Price Decline

Technical analysis provides insights into XRP’s price movements using charts and indicators to identify patterns and potential future trends. Analyzing XRP’s technical indicators can help investors make informed decisions about buying or selling.

4.1 Price Charts and Trend Analysis

Examining XRP’s price charts reveals key trends and patterns. Bearish trends, characterized by lower highs and lower lows, indicate a potential continued decline. Support and resistance levels can also provide insights into potential price targets and reversal points.

4.2 Key Technical Indicators: RSI, MACD

Key technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) provide additional insights into XRP’s price momentum. RSI values below 30 suggest that XRP is oversold, potentially signaling a buying opportunity. MACD crossovers can indicate changes in price direction.

4.3 Volume Analysis and Price Confirmation

Volume analysis is essential for confirming price trends. High trading volumes during price declines can validate the bearish trend, while low volumes may indicate a lack of conviction among sellers. Analyzing volume alongside price movements helps investors assess the strength and sustainability of price trends.

4.4 Potential Support and Resistance Levels

Identifying potential support and resistance levels can help investors anticipate future price movements. Support levels act as price floors, where buying pressure is expected to increase, preventing further declines. Resistance levels act as price ceilings, where selling pressure is likely to intensify, capping potential gains.

5. Ripple’s Legal Battle with the SEC

Ripple’s legal battle with the SEC has been a major factor influencing XRP’s price. The lawsuit alleges that Ripple Labs sold XRP as an unregistered security, which has led to significant market uncertainty.

5.1 Overview of the SEC Lawsuit

The SEC lawsuit, filed in December 2020, alleges that Ripple Labs and its executives sold XRP as an unregistered security, violating U.S. securities laws. The lawsuit claims that XRP should have been registered with the SEC before being offered to the public.

5.2 Impact of the Lawsuit on XRP’s Price

The SEC lawsuit caused immediate and significant price drops for XRP. Major cryptocurrency exchanges, including Coinbase and Binance.US, delisted XRP from their platforms in response to the legal action, further reducing its accessibility and liquidity.

5.3 Key Arguments and Legal Developments

Ripple Labs has defended itself against the SEC’s allegations, arguing that XRP functions as a currency and does not meet the definition of a security. The legal battle has involved numerous filings, hearings, and discovery processes, with no definitive resolution as of now.

5.4 Potential Outcomes and Market Implications

The outcome of the SEC lawsuit will have significant implications for XRP’s future. A favorable ruling for Ripple Labs could restore investor confidence and potentially lead to relistings on major exchanges, driving up the price. Conversely, an unfavorable ruling could further depress XRP’s price and limit its accessibility to U.S. investors.

6. XRP’s Utility and Use Cases

XRP’s utility and use cases are critical factors determining its long-term value. Understanding how XRP is used in real-world applications helps investors assess its potential for growth and adoption.

6.1 XRP for Cross-Border Payments

XRP is primarily designed for facilitating fast and low-cost cross-border payments. Ripple’s technology aims to streamline international transactions, making them more efficient and cost-effective compared to traditional methods like SWIFT.

6.2 Partnerships with Financial Institutions

Ripple has partnered with numerous financial institutions to integrate XRP into their payment systems. These partnerships aim to leverage XRP’s speed and cost-effectiveness to improve cross-border payment processes.

6.3 XRP’s Role in RippleNet

XRP plays a crucial role in RippleNet, Ripple’s network of financial institutions using Ripple’s technology. RippleNet enables real-time gross settlement, currency exchange, and remittance services, with XRP serving as a bridge currency for these transactions.

6.4 Adoption Challenges and Future Prospects

Despite its potential, XRP faces adoption challenges, including regulatory uncertainty and competition from other payment solutions. Overcoming these challenges and expanding its utility will be critical for XRP to achieve long-term success.

7. Expert Opinions and Forecasts on XRP

Expert opinions and forecasts provide valuable insights into the potential future of XRP. Analyzing various perspectives can help investors form a more balanced view of XRP’s prospects.

7.1 Analysis from Crypto Analysts

Crypto analysts offer diverse opinions on XRP’s future. Some analysts highlight XRP’s potential for growth, citing its technological advantages and partnerships. Others express caution due to regulatory risks and market competition.

7.2 Long-Term Price Predictions

Long-term price predictions for XRP vary widely. Some forecasts suggest substantial price appreciation based on increased adoption and regulatory clarity, while others anticipate continued volatility and uncertainty.

7.3 Factors Influencing Expert Opinions

Expert opinions are influenced by various factors, including technical analysis, fundamental analysis, and market sentiment. Analysts consider regulatory developments, technological advancements, and competition when forming their views on XRP.

7.4 Cautions and Disclaimers

It is essential to approach expert opinions and forecasts with caution. The cryptocurrency market is highly unpredictable, and no prediction can be guaranteed. Investors should conduct their own research and consider their risk tolerance before making investment decisions.

8. Managing Risk When Investing in XRP

Investing in XRP, like any cryptocurrency, involves significant risks. Implementing effective risk management strategies is crucial for protecting your investment.

8.1 Understanding Cryptocurrency Risks

Cryptocurrency investments are subject to various risks, including market volatility, regulatory uncertainty, security breaches, and technological risks. Understanding these risks is essential for making informed investment decisions.

8.2 Diversification Strategies

Diversification involves spreading your investments across different assets to reduce risk. Instead of putting all your capital into XRP, consider investing in other cryptocurrencies, stocks, bonds, or commodities.

8.3 Setting Stop-Loss Orders

Stop-loss orders automatically sell your XRP if the price drops to a specified level. Setting stop-loss orders can help limit your potential losses during market downturns.

8.4 Long-Term vs. Short-Term Investing

Consider your investment horizon when investing in XRP. Long-term investors may be willing to ride out market volatility, while short-term traders may focus on capturing quick profits. Tailor your investment strategy to your goals and risk tolerance.

9. Alternative Cryptocurrencies to Consider

Exploring alternative cryptocurrencies can provide diversification and potential growth opportunities. Consider these options if you are evaluating XRP.

9.1 Bitcoin (BTC)

Bitcoin is the original cryptocurrency and remains the most dominant digital asset. It offers a store of value and a decentralized payment system, making it a popular choice for investors.

9.2 Ethereum (ETH)

Ethereum is a blockchain platform that enables the creation of decentralized applications (dApps) and smart contracts. Its versatility and widespread adoption make it a leading cryptocurrency.

9.3 Cardano (ADA)

Cardano is a blockchain platform focused on sustainability and scalability. Its peer-reviewed research and development approach make it a promising alternative to XRP.

9.4 Solana (SOL)

Solana is a high-performance blockchain platform known for its fast transaction speeds and low fees. Its innovative architecture and growing ecosystem make it a competitive alternative to XRP.

10. Future Outlook for XRP and the Cryptocurrency Market

The future outlook for XRP and the cryptocurrency market remains uncertain. However, several trends and developments could shape their trajectory.

10.1 Regulatory Trends and Policies

Regulatory trends and policies will play a critical role in the future of XRP and the cryptocurrency market. Increased regulatory clarity and supportive policies could foster adoption and growth, while restrictive regulations could hinder progress.

10.2 Technological Innovations

Technological innovations will continue to drive the evolution of cryptocurrencies. Advancements in blockchain technology, scalability solutions, and security protocols could enhance the functionality and appeal of XRP and other digital assets.

10.3 Institutional Adoption

Institutional adoption could significantly boost the cryptocurrency market. Increased investment from institutional investors, such as hedge funds, pension funds, and corporations, could provide stability and liquidity.

10.4 Market Maturity and Stability

As the cryptocurrency market matures, it may become more stable and less volatile. Increased liquidity, wider adoption, and improved regulatory frameworks could contribute to greater market stability.

11. Summary: Key Takeaways on XRP’s Price Decline

Several factors have contributed to XRP’s price decline, including market sentiment, regulatory challenges, technological developments, and competition from other cryptocurrencies. Understanding these factors is essential for investors making informed decisions.

11.1 Factors Contributing to Price Drops

Market sentiment, regulatory developments, technological advancements, and competition from other cryptocurrencies have all contributed to XRP’s price decline. The U.S. Bitcoin Strategic Reserve announcement and the White House Crypto Summit have also created uncertainty in the market.

11.2 Ripple’s Ongoing Legal Challenges

Ripple’s ongoing legal battle with the SEC has been a major factor influencing XRP’s price. The lawsuit alleges that Ripple Labs sold XRP as an unregistered security, which has led to significant market uncertainty and delistings from major exchanges.

11.3 Strategies for Investors

Investors should consider diversifying their portfolios, setting stop-loss orders, and understanding the risks involved in cryptocurrency investments. Approaching expert opinions and forecasts with caution is also essential.

11.4 Future Considerations

The future outlook for XRP and the cryptocurrency market remains uncertain. Regulatory trends, technological innovations, and institutional adoption could shape their trajectory.

12. Conclusion: Navigating XRP’s Volatility with Informed Decisions

Navigating XRP’s volatility requires informed decision-making and a thorough understanding of market dynamics. Investors should stay updated on regulatory developments, technological advancements, and market trends to make sound investment choices.

12.1 The Importance of Staying Informed

Staying informed about XRP and the cryptocurrency market is crucial for making informed investment decisions. Continuous research and analysis can help investors anticipate potential price movements and manage risk effectively.

12.2 Making Informed Investment Choices

Informed investment choices are essential for navigating XRP’s volatility. Consider your risk tolerance, investment horizon, and financial goals when making investment decisions.

12.3 Seeking Professional Financial Advice

Seeking professional financial advice can provide valuable guidance and support for managing your investments. Financial advisors can help you develop a personalized investment strategy tailored to your needs and goals.

12.4 Leveraging Resources from WHY.EDU.VN

WHY.EDU.VN provides valuable resources and expert insights to help you stay informed and make informed investment decisions. Visit our website for the latest news, analysis, and educational content on XRP and the cryptocurrency market.

Are you struggling to find reliable answers to your pressing questions about cryptocurrencies or any other complex topic? Do you feel overwhelmed by the vast amount of information available online and unsure of where to turn for expert guidance? At WHY.EDU.VN, we understand these challenges and are here to provide you with the solutions you need. Our platform offers detailed, easy-to-understand explanations, expert analyses, and diverse perspectives on a wide range of subjects.

We ensure the accuracy and reliability of our information, connecting you with top professionals for direct answers to your questions. Don’t let uncertainty hold you back. Visit WHY.EDU.VN today to ask your questions and discover the clarity and insights you’ve been searching for.

Address: 101 Curiosity Lane, Answer Town, CA 90210, United States.

Whatsapp: +1 (213) 555-0101.

Website: WHY.EDU.VN

Frequently Asked Questions (FAQ)

1. Why is XRP dropping right now?

XRP’s price can drop due to various factors, including negative market sentiment, unfavorable regulatory news, technological setbacks, or increased competition from other cryptocurrencies.

2. How does the SEC lawsuit affect XRP’s price?

The SEC lawsuit alleging that Ripple Labs sold XRP as an unregistered security has significantly impacted XRP’s price, leading to price drops and delistings from major cryptocurrency exchanges.

3. What are the key technical indicators to watch for XRP?

Key technical indicators to watch for XRP include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and volume analysis.

4. Is XRP a good investment?

Whether XRP is a good investment depends on your risk tolerance, investment horizon, and financial goals. Consider conducting thorough research and seeking professional financial advice before investing.

5. What are some alternative cryptocurrencies to consider?

Alternative cryptocurrencies to consider include Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Solana (SOL).

6. How can I manage risk when investing in XRP?

You can manage risk by diversifying your portfolio, setting stop-loss orders, and understanding the risks involved in cryptocurrency investments.

7. What is Ripple’s role in cross-border payments?

Ripple aims to streamline international transactions by providing faster and more cost-effective solutions compared to traditional methods like SWIFT.

8. What is the future outlook for XRP?

The future outlook for XRP depends on regulatory trends, technological innovations, and institutional adoption. Increased regulatory clarity and supportive policies could foster growth.

9. How can I stay informed about XRP news and developments?

Stay informed by following reputable cryptocurrency news sources, consulting with financial advisors, and leveraging resources from why.edu.vn.

10. What are the potential outcomes of the SEC lawsuit for XRP?

A favorable ruling for Ripple Labs could restore investor confidence and potentially lead to relistings on major exchanges, while an unfavorable ruling could further depress XRP’s price and limit its accessibility to U.S. investors.