On Wednesday, January 15, 2025, the U.S. Bureau of Labor Statistics (BLS) released its latest Consumer Price Index (CPI) report, revealing a 0.4% increase in December. This figure surpassed November’s 0.3% rise and slightly exceeded economists’ expectations, signaling persistent inflationary pressures within the US economy.

According to the official report from the BLS, “The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent on a seasonally adjusted basis in December, after rising 0.3 percent in November. Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment.” This news has had a significant impact across financial markets, particularly within the cryptocurrency sector, prompting a notable surge in prices.

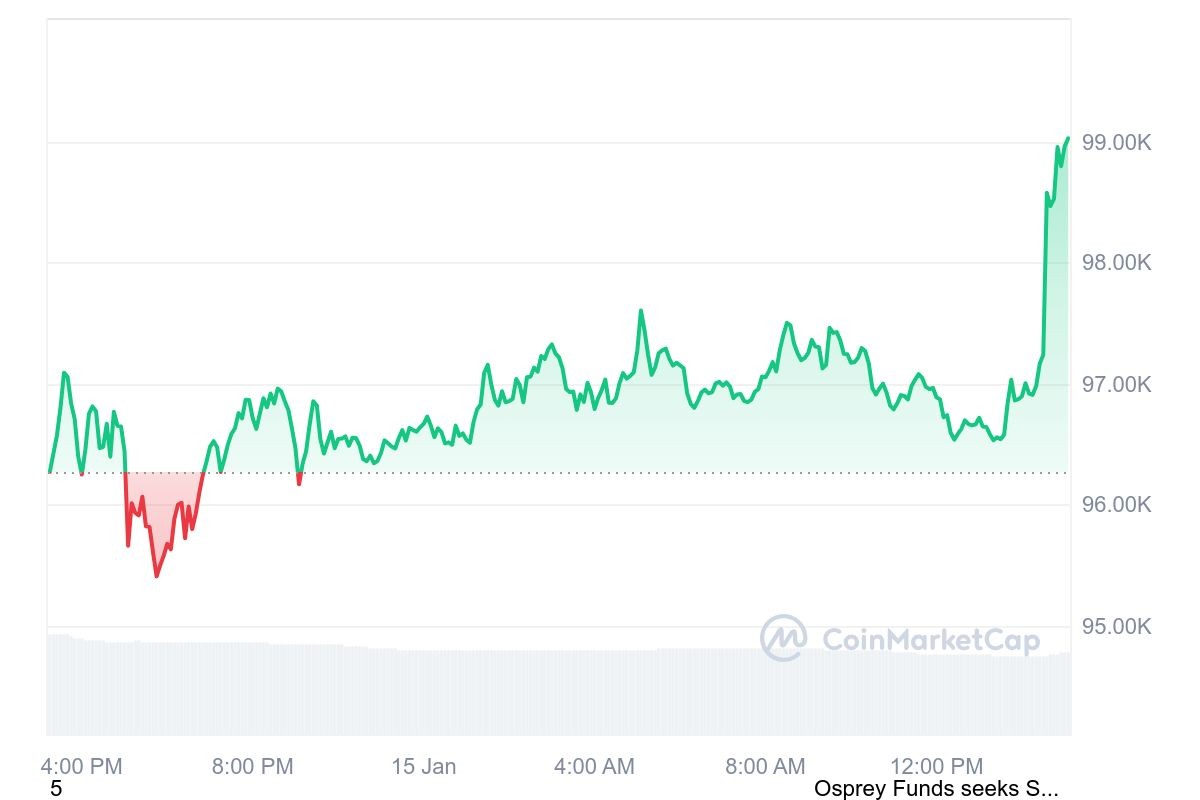

The unexpected uptick in monthly inflation has shifted market sentiment regarding the Federal Reserve’s monetary policy. The CME FedWatch Tool now indicates a heightened 30% probability of an interest rate cut as early as the March meeting. This anticipation of potential easing by the Fed is a key factor driving the current crypto market rally. Immediately following the CPI announcement, Bitcoin Bitcoin experienced a rapid 1.4% jump, reaching $98,500 and subsequently climbing to a daily high of $99,400.

This upward movement in Bitcoin’s price further solidifies the bullish signal previously observed in the market. The recent price action has validated the bullish doji candle formation from the previous day, which occurred when Bitcoin briefly dipped below $90,000. Should this trend persist, market analysts suggest that breaching the $100,000 mark for Bitcoin is increasingly likely in the near term. Such a breakthrough would pave the way for Bitcoin to challenge its all-time high, which sits above $108,000.

Expert Analysis on Crypto Market Surge

Paul Howard, Senior Director at Wincent, a leading liquidity provider in digital assets, offered insights on the current market dynamics. Speaking with Finance Magnates, Howard noted, “Crypto remains a key indicator of risk assets, and with CPI and inflation figures exceeding expectations, this improvement is evident in current pricing.”

Howard further highlighted the potential for market volatility in the coming days, “As a leading liquidity provider in digital assets, we anticipate a highly volatile week ahead, particularly with the transition of administration in the US, which could result in +/-10% price swings for major assets like BTC, SOL, ETH, and XRP.”

Altcoins Rally in Bitcoin’s Wake: Ethereum and XRP See Gains

The positive momentum initiated by Bitcoin quickly extended to the broader altcoin market. Ethereum Ethereum, the second-largest cryptocurrency by market capitalization, mirrored Bitcoin’s upward trajectory, climbing 3% within an hour to reach $3,300. Similarly, XRP experienced a significant increase, jumping 2.6% to trade at $2.57.

The overall cryptocurrency market capitalization witnessed a substantial 5.6% increase, reaching $3.33 trillion. Trading activity also surged, with daily trading volume across cryptocurrency exchanges jumping by 25% to $154 billion, according to data from CoinMarketCap.

Howard further elaborated on factors that could influence future market movements, stating, “Market pricing will likely respond to announcements made by the incoming President, suggesting that current valuations may not fully account for upcoming news.” He emphasized the potential long-term implications of these announcements, particularly concerning “regulatory clarity, adjustments to banking policies, and leadership in matters like a strategic bitcoin reserve,” which could shape the cryptocurrency landscape throughout the year.

In conclusion, the recent surge in crypto prices, led by Bitcoin and followed by altcoins, is primarily attributed to the higher-than-expected US CPI inflation report. This data release has fueled expectations of earlier interest rate cuts by the Federal Reserve, making risk assets like cryptocurrencies more attractive to investors. While the market exhibits strong bullish momentum, experts caution about potential volatility in the near term due to upcoming economic and political announcements.