Bitcoin’s price is once again making headlines as it approaches the significant $100,000 mark. This surge comes on the heels of the latest inflation data from the United States, which has fueled speculation about potential shifts in Federal Reserve policy. Along with Bitcoin, the broader cryptocurrency market, including altcoins, is experiencing an upswing as investors anticipate that the Federal Reserve might be compelled to implement interest rate cuts sooner than previously projected.

On Wednesday, January 15, 2025, the U.S. Bureau of Labor Statistics (BLS) released its report on the Consumer Price Index (CPI), revealing a 0.4% increase in December. This figure, representing the rise in the cost of goods and services, provides a key insight into the current economic landscape.

According to the official report from the BLS, “The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent on a seasonally adjusted basis in December, after rising 0.3 percent in November. Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment.” This persistent inflation, even if moderate, is a crucial factor influencing market sentiment and monetary policy expectations.

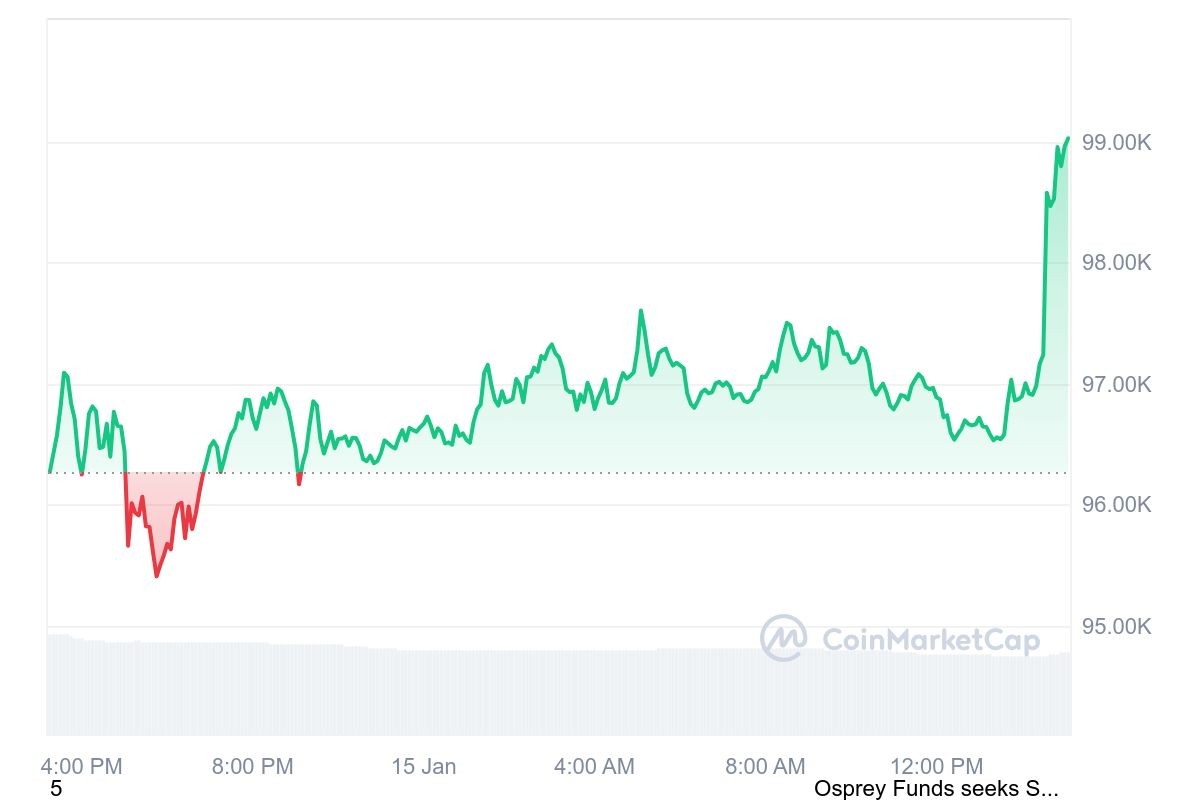

The slightly higher-than-expected monthly inflation reading has notably impacted predictions regarding the Federal Reserve’s future actions. The CME FedWatch Tool, which tracks market expectations for Fed rate changes, now indicates a 30% probability of an interest rate cut as early as the March meeting. This anticipation of loosened monetary policy is a significant driver behind the current cryptocurrency market rally. Immediately following the CPI report release, Bitcoin reacted strongly, jumping 1.4% to $98,500 and subsequently reaching a daily high of $99,400.

This upward price movement in Bitcoin has also validated previous bullish signals observed in market analysis. The recent price action has confirmed a bullish doji candle formation, which appeared when Bitcoin briefly dipped below $90,000. Market analysts suggest that if this positive trend continues, it is increasingly likely that Bitcoin will surpass the $100,000 barrier soon, paving the way to potentially retest its all-time high above $108,000.

Paul Howard, Senior Director at Wincent, a liquidity provider in digital assets, offered expert commentary on the market dynamics. Speaking to Finance Magnates, Howard stated, “Crypto remains a key indicator of risk assets, and with CPI and inflation figures exceeding expectations, this improvement is evident in current pricing.” He further emphasized the potential for market volatility, particularly with upcoming political transitions in the US, which could trigger significant price fluctuations in major cryptocurrencies.

Altcoins Surge in Bitcoin’s Wake

The positive momentum in the cryptocurrency market is not limited to Bitcoin alone. Altcoins, including Ethereum and XRP, are also experiencing substantial gains. Ethereum, the second-largest cryptocurrency by market capitalization, has risen by 3% in the past hour, reaching $3,300. Similarly, XRP has seen a 2.6% increase, climbing to $2.57.

The overall cryptocurrency market capitalization has seen a significant surge, increasing by 5.6% to reach $3.33 trillion. Trading activity has also intensified, with daily trading volume jumping by 25% to $154 billion, according to data from CoinMarketCap. This broad-based market rally indicates a strong positive sentiment across the cryptocurrency space.

Howard further noted the potential impact of forthcoming announcements from the incoming US President on market pricing. He suggested that current market valuations may not fully reflect the implications of these anticipated announcements, particularly concerning regulatory clarity, banking policy adjustments, and the possibility of a strategic bitcoin reserve. These factors could have long-lasting effects on the cryptocurrency market throughout the year.

In conclusion, Bitcoin’s current price surge, alongside the broader crypto market rally, is primarily driven by the higher-than-expected US CPI inflation data. This data has strengthened expectations for earlier Federal Reserve interest rate cuts, making risk assets like Bitcoin more attractive to investors. As the market anticipates further economic and political developments, continued volatility and price movements are expected in the cryptocurrency space.