Gold price is increasing, and understanding the reasons behind this surge is crucial for investors, economists, and anyone interested in financial markets. WHY.EDU.VN delves into the factors driving gold’s value, offering insights into investment strategies and the broader economic landscape. Discover the dynamics of gold prices, market influences, and wealth preservation techniques.

1. Understanding Gold’s Role as a Financial Asset

Gold is more than just jewelry or an industrial component. It functions as a significant financial asset, influencing price fluctuations. These fluctuations largely mirror its role as a financial instrument. While gold is mined and used in industrial and consumer goods, its history as a valuable holding for private investors and central banks leads to substantial changes in demand, impacting price movements. Gold’s role as a financial asset is particularly evident during economic shifts.

- Historical Significance: Historically, gold has been a reliable store of value.

- Investor and Central Bank Influence: Demand shifts from investors and central banks play a crucial role.

- Price Movements: These shifts significantly affect gold price movements.

2. Private Investors and Gold: Speculation and Hedging

For private investors, gold presents a unique asset without explicit yield like bonds or stocks. Investors are motivated by expected price increases, aiming to profit from higher selling prices, despite the risk of capital losses. Price swings mirror changing beliefs about gold’s future value, creating opportunities for speculative gains and hedging against losses from other assets. Gold-backed exchange-traded funds (ETFs), introduced in the early 2000s, significantly expanded gold’s investor base, facilitating rapid shifts between gold and other assets.

- No Explicit Yield: Unlike bonds or stocks, gold offers no direct income.

- Speculative Gains: Investors aim to profit from price increases.

- Hedge Against Losses: Gold serves as a hedge against other asset losses.

- Gold-Backed ETFs: Expanded investor base and facilitated rapid asset shifts.

3. Gold as an Inflation Hedge: Protecting Against Economic Instability

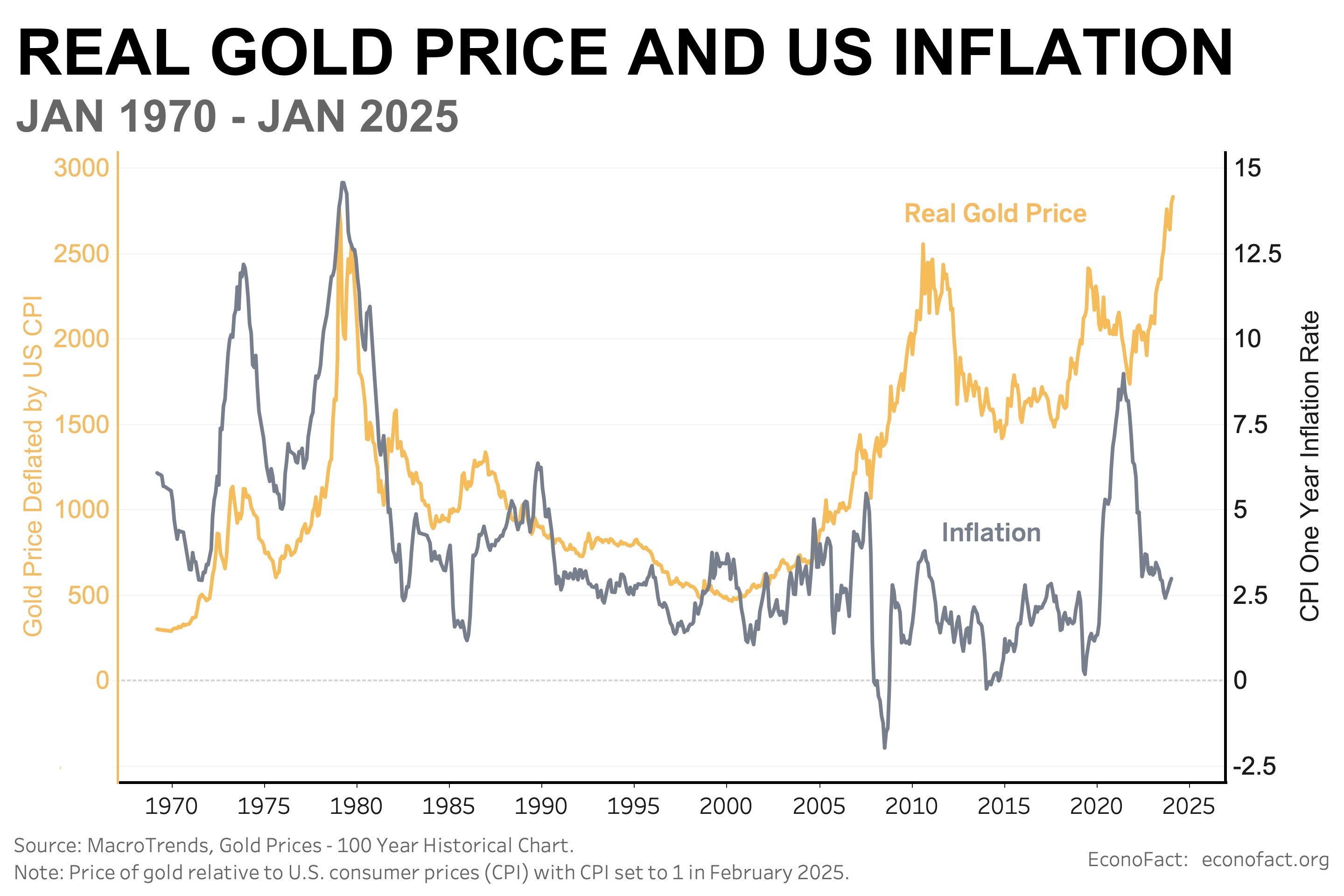

Gold is often seen as a tool to protect against inflation. Rising inflation erodes the value of cash and fixed-interest rate assets like treasury bonds. Gold protects against these losses as its price tends to rise when the real values of other assets fall. This motivation is visible in gold price movements during the 1970s and early 1980s, when inflation surged after sharp oil price increases and was subsequently controlled by monetary tightening.

Alt text: Historical correlation between real gold price and US inflation rates, illustrating gold’s role as an inflation hedge.

- Inflation Protection: Gold protects against the devaluation of cash and fixed-interest assets.

- Inverse Correlation: Gold prices tend to rise as other asset values fall during inflation.

- Historical Example: Gold price movements in the 1970s and early 1980s exemplify this protection.

4. Gold as a Safe Haven: Uncertainty and Economic Turmoil

Gold offers private investors an effective hedge against other risks, including economic uncertainty that can harm the stock market. Investors often see gold as a safe haven during economic turmoil. For example, gold prices jumped 22 percent during the first six months of the COVID pandemic. Although inflation remained below 1.5 percent, there was a significant loss of economic confidence and a drop in equity prices. The figure below illustrates the price of gold and a global uncertainty index.

Alt text: Graph depicting the correlation between real gold prices and a global economic uncertainty index, showcasing gold as a safe haven asset.

- Hedge Against Risk: Gold protects against economic uncertainty.

- Safe Haven Status: Investors view gold as a safe haven during crises.

- COVID-19 Example: Gold prices rose 22 percent during the first six months of the pandemic.

5. Opportunity Costs: Real Returns on Government Bonds

While investors value gold as a means of speculation or a hedge against risk, they must consider the opportunity costs of holding gold versus safe assets like government bonds that bear interest. Government bonds offer a positive real (inflation-adjusted) rate of return when their interest yield is above the inflation rate. Higher real returns on government bonds increase the sacrifice of holding gold and lower the price of gold.

- Opportunity Costs: Investors must consider the trade-offs of holding gold versus interest-bearing assets.

- Real Returns: Government bonds with higher real returns reduce the attractiveness of gold.

- Price Impact: Higher real returns on bonds tend to lower gold prices.

6. Central Bank Demand: Impact of Geopolitical Events

An additional factor affecting gold prices is increased central bank demand, particularly since the sanctions imposed on Russia after its invasion of Ukraine. Gold was a key component of central bank reserves from 1945 to 1973, under the fixed exchange rate system where major currencies were tied to the U.S. dollar, which was convertible to gold at $35/ounce. While the role of gold as a central bank reserve diminished after this system collapsed in March 1973, central banks continued to hold gold in their international reserves. Since 2010, central banks of Russia and China have increased their physical gold holdings as part of a reserve diversification strategy. Central bank purchases of gold dramatically accelerated after the February 2022 Russian invasion of Ukraine, which led to Western sanctions.

- Central Bank Reserves: Gold was a key component of central bank reserves under the fixed exchange rate system.

- Reserve Diversification: Russia and China increased gold holdings to diversify reserves.

- Geopolitical Impact: Central bank purchases accelerated after the Russian invasion of Ukraine.

7. Factors Driving the Rapid Increase in Gold Prices: An Empirical Analysis

Which factors have driven the rapid increase in gold prices over the past year? To disentangle these effects, a systematic empirical analysis of the determinants of gold prices from 2003 to early 2025 was conducted. This estimation updates and extends an analysis published by the Federal Reserve Bank of Chicago for a sample that ended in 2021. The estimates show that gold prices are higher when real interest rates are lower, when uncertainty is higher, and since the Russian invasion of Ukraine in February 2022.

- Empirical Analysis: A systematic analysis identified key factors driving gold price increases.

- Key Factors: Lower real interest rates, higher uncertainty, and the Russian invasion of Ukraine.

- Updated Analysis: The estimation updates and extends a previous analysis by the Federal Reserve Bank of Chicago.

8. The Dominant Factor: Global Economic Uncertainty

Based on these results, the main factor driving the recent surge in gold prices is the increase in global economic uncertainty over the past year. The uncertainty index rose from normal levels in early 2024 to much higher levels in November-December and continued to rise in early 2025 to levels comparable to the peak of the COVID pandemic in 2020. This increase accounted for almost half (47 percent) of the rise in gold prices over the year ending in January 2025.

- Main Driver: Global economic uncertainty is the primary factor.

- Uncertainty Index: The uncertainty index rose to levels comparable to the peak of the COVID pandemic.

- Price Impact: This increase accounted for nearly half of the rise in gold prices.

9. Additional Contributors: Inflation Expectations and Central Bank Purchases

Some pick-up in inflation expectations from late 2024 also contributed modestly (6 percent) to the rise of gold prices in this period. However, central bank purchases, which continued in 2024 and early 2025 at much the same pace as in 2022-2023, did not have a significant impact.

- Inflation Expectations: Modestly contributed to the rise in gold prices.

- Central Bank Purchases: Continued at the same pace but had little impact.

10. Historical Parallels: COVID-19 Pandemic and Global Policy Uncertainty

Big run-ups in the price of gold have happened before. The present run-up seems most similar to that which occurred in the first half of 2020 related to the jump in economic uncertainty related to the COVID pandemic. Market commentary and news reporting suggest that the recent spike in global policy uncertainty is particularly reflected in the massive spike in trade policy uncertainty since November 2024. The increase in uncertainty is likely related to the threat of substantial tariff increases on the United States’ main trading partners and their potential impact on inflation, global supply chains, and geopolitical tensions.

- Historical Context: Previous run-ups in gold prices mirror those during the COVID-19 pandemic.

- Global Policy Uncertainty: The recent spike in trade policy uncertainty is a key factor.

- Trade Policy Impact: The threat of tariff increases and their impact on the global economy.

11. Impact of Trade Policy Uncertainty on Gold Prices

Trade policy uncertainty can significantly impact gold prices. When trade policies become unpredictable, investors often seek safe-haven assets like gold. The uncertainty surrounding potential tariffs and trade restrictions can lead to concerns about economic stability and inflation, driving investors towards gold as a hedge against these risks. This phenomenon highlights the interconnectedness of global trade policies and financial markets.

| Factor | Description | Impact on Gold Prices |

|---|---|---|

| Trade Policy Uncertainty | Unpredictable trade policies and potential tariffs | Increases demand for gold as a safe-haven asset |

| Economic Stability Concerns | Investors worry about the potential impact of trade policies on economic growth and market stability | Drives investors toward gold as a hedge against economic downturns |

| Inflation Concerns | Tariffs can lead to higher prices, causing investors to seek inflation-resistant assets like gold | Boosts gold prices as investors aim to preserve purchasing power |

| Geopolitical Tensions | Trade disputes can escalate geopolitical tensions, prompting investors to seek safe and stable assets | Increases demand for gold as a store of value during times of international instability |

12. The Role of Real Interest Rates in Gold Valuation

Real interest rates play a crucial role in the valuation of gold. When real interest rates are low or negative, the opportunity cost of holding gold decreases, making it a more attractive investment. Conversely, when real interest rates are high, investors may prefer interest-bearing assets over gold. This inverse relationship between real interest rates and gold prices is a fundamental concept in financial economics.

- Low Real Interest Rates: Decreases the opportunity cost of holding gold.

- High Real Interest Rates: Makes interest-bearing assets more attractive.

- Inverse Relationship: A fundamental concept in financial economics.

13. Central Banks’ Influence on Gold Demand

Central banks significantly influence gold demand through their reserve management strategies. As central banks diversify their reserves away from traditional currencies like the U.S. dollar, they often increase their gold holdings. This trend has been particularly evident in countries like Russia and China, which have actively sought to reduce their dependence on the dollar. Central bank purchases can create substantial upward pressure on gold prices.

| Region/Country | Reserve Diversification Strategy | Impact on Gold Demand |

|---|---|---|

| Russia | Actively reducing dependence on the U.S. dollar by increasing gold reserves | Substantial increase in gold purchases, contributing to higher gold prices |

| China | Diversifying reserves to reduce reliance on the U.S. dollar, with a focus on increasing gold holdings | Gradual but steady increase in gold purchases, exerting upward pressure on gold prices |

| Emerging Markets | Diversifying reserves to reduce risk and increase stability, with gold as a key component of their reserve assets | Increased demand for gold as a stable store of value, supporting overall gold prices |

| Developed Nations | Maintaining gold reserves as a hedge against economic uncertainty and currency volatility, with strategic adjustments based on market conditions | Strategic adjustments to gold reserves, providing stability and support to gold prices during periods of economic or financial stress |

14. Understanding Global Economic Indicators

Global economic indicators such as GDP growth, unemployment rates, and inflation expectations are closely watched by investors to assess the overall health of the global economy. These indicators can significantly influence investment decisions, including allocations to gold. Strong economic growth typically reduces the demand for safe-haven assets like gold, while economic slowdowns tend to increase it.

- GDP Growth: Strong growth reduces demand for gold.

- Unemployment Rates: High unemployment increases demand for gold.

- Inflation Expectations: Rising inflation expectations increase demand for gold.

15. Geopolitical Risks and Their Impact on Gold

Geopolitical risks, including armed conflicts, political instability, and international tensions, can drive investors towards gold as a safe haven. The uncertainty surrounding these events often leads to increased demand for gold, which is seen as a stable and reliable store of value during turbulent times. The recent increase in global policy uncertainty, particularly related to trade policies, exemplifies this dynamic.

- Armed Conflicts: Increase demand for gold as a safe haven.

- Political Instability: Leads to uncertainty and higher gold demand.

- International Tensions: Prompt investors to seek safe and stable assets like gold.

16. Gold Mining Supply and Demand Dynamics

The supply of gold from mining activities and the demand for gold from various sectors, including jewelry, industry, and investment, play a role in determining gold prices. Changes in mining production, technological advancements, and consumer preferences can influence the overall supply and demand balance, affecting gold prices.

| Factor | Description | Impact on Gold Prices |

|---|---|---|

| Mining Production | The total amount of gold extracted from mines worldwide | Higher production can increase supply and potentially lower prices; lower production can decrease supply and raise prices |

| Technological Advancements | Innovations in mining technology that improve efficiency and reduce costs | Can increase gold supply and put downward pressure on prices if extraction becomes more efficient |

| Jewelry Demand | The demand for gold used in jewelry, influenced by consumer preferences and cultural factors | Higher demand for jewelry can increase overall demand and drive up gold prices |

| Industrial Demand | The demand for gold used in industrial applications, such as electronics and medical devices | Higher industrial demand can contribute to overall demand and support gold prices |

| Investment Demand | The demand for gold as an investment, including physical gold, ETFs, and other financial instruments | Higher investment demand can significantly increase overall demand and drive up gold prices |

17. Analyzing the Correlation Between Gold and the U.S. Dollar

Gold and the U.S. dollar often exhibit an inverse correlation, meaning that when the value of the dollar decreases, the price of gold tends to increase, and vice versa. This relationship is driven by the fact that gold is often priced in U.S. dollars, and a weaker dollar makes gold more affordable for international investors. Changes in U.S. monetary policy and economic conditions can affect the dollar’s value and, consequently, gold prices.

- Inverse Correlation: Gold prices tend to increase when the dollar weakens and vice versa.

- Pricing in U.S. Dollars: A weaker dollar makes gold more affordable for international investors.

- Monetary Policy Impact: Changes in U.S. monetary policy affect the dollar’s value and gold prices.

18. Understanding the Impact of Inflation on Gold Prices

Inflation erodes the purchasing power of currencies, making gold an attractive hedge against inflation. As inflation rates rise, investors often seek to protect their wealth by investing in gold, which is perceived as a store of value that can maintain its worth during inflationary periods. This increased demand for gold can drive up its price.

| Inflation Scenario | Investor Behavior | Impact on Gold Prices |

|---|---|---|

| Low Inflation | Investors may focus on other asset classes with higher returns, such as stocks or bonds | Lower demand for gold may lead to stable or slightly decreasing gold prices |

| Moderate Inflation | Investors start to consider gold as a hedge against inflation, but may still allocate a portion of their portfolio to other assets | Increased demand for gold may lead to moderate increases in gold prices |

| High Inflation | Investors aggressively seek gold to protect their wealth, reducing allocations to other asset classes | Significant increase in demand for gold, leading to substantial increases in gold prices |

| Hyperinflation | Investors flee from currency and seek safe-haven assets like gold, regardless of price | Extreme increase in demand for gold, potentially leading to very high and volatile gold prices |

19. The Role of Gold in Portfolio Diversification

Gold plays a crucial role in portfolio diversification by providing a hedge against market volatility and economic uncertainty. Its low or negative correlation with other asset classes, such as stocks and bonds, can help reduce overall portfolio risk and improve long-term returns. Investors often allocate a portion of their portfolio to gold to enhance diversification and protect against potential losses in other asset classes.

- Hedge Against Volatility: Gold provides a hedge against market volatility.

- Low Correlation: Gold has a low or negative correlation with other asset classes.

- Risk Reduction: Gold can help reduce overall portfolio risk.

20. Expert Opinions on the Future of Gold Prices

Expert opinions on the future of gold prices vary, with some analysts predicting continued increases due to ongoing economic uncertainty and geopolitical risks, while others anticipate a potential correction as interest rates rise and economic conditions improve. These differing viewpoints highlight the complexity of forecasting gold prices and the importance of considering a range of factors when making investment decisions.

| Expert Opinion | Rationale |

|---|---|

| Continued Increases | Ongoing economic uncertainty, geopolitical risks, and potential for higher inflation are expected to drive demand for gold as a safe-haven asset, leading to higher prices. |

| Potential Correction | Rising interest rates and improving economic conditions may reduce demand for gold, leading to a correction in prices. |

| Price Volatility | Gold prices are expected to remain volatile due to fluctuations in economic data, policy changes, and geopolitical events. |

| Long-Term Value | Gold is expected to maintain its long-term value as a store of wealth and a hedge against currency devaluation, making it a valuable asset for long-term investors. |

21. Gold Price Predictions for the Next Decade

Predicting gold prices for the next decade involves considering numerous factors such as inflation, interest rates, geopolitical stability, and central bank policies. While precise predictions are challenging, analysts often use economic models and historical data to forecast potential price ranges. These forecasts are crucial for long-term investment strategies.

| Scenario | Key Factors | Potential Gold Price Range (per ounce) |

|---|---|---|

| Bullish (High Growth and Inflation) | High inflation rates, low real interest rates, increased geopolitical tensions, and continued central bank buying. | $3,500 – $5,000+ |

| Base Case (Moderate Growth and Inflation) | Moderate inflation rates, gradual increase in real interest rates, stable geopolitical environment, and steady central bank policies. | $2,500 – $3,500 |

| Bearish (Low Growth and Deflation) | Low inflation or deflation, high real interest rates, decreased geopolitical tensions, and reduced central bank buying or selling of gold reserves. | $1,500 – $2,500 |

22. Strategies for Investing in Gold

There are several strategies for investing in gold, including purchasing physical gold (coins, bars), investing in gold ETFs, and buying shares of gold mining companies. Each strategy has its own advantages and disadvantages, and the best approach depends on an investor’s risk tolerance, investment goals, and time horizon.

| Investment Strategy | Description | Advantages | Disadvantages |

|---|---|---|---|

| Physical Gold (Coins/Bars) | Purchasing physical gold in the form of coins or bars and storing it securely | Tangible asset, no counterparty risk, potential for capital appreciation | Storage costs, insurance, potential for theft, illiquidity |

| Gold ETFs | Investing in exchange-traded funds that track the price of gold | Liquid, easy to trade, low storage costs, diversification | Counterparty risk, tracking error, expense ratios |

| Gold Mining Stocks | Buying shares of companies that are involved in gold mining operations | Potential for high returns, leverage to gold prices, dividend income | Company-specific risk, operational challenges, regulatory risks, sensitivity to broader market conditions |

| Gold Futures and Options | Trading contracts that give the holder the right to buy or sell gold at a predetermined price and date | Potential for high returns, leverage, hedging opportunities | High risk, requires specialized knowledge, potential for significant losses |

23. The Impact of Global Crises on Gold Demand

Global crises, such as financial meltdowns, pandemics, and geopolitical conflicts, tend to increase gold demand as investors seek safe-haven assets to protect their wealth. During these times, gold prices often rise sharply due to increased demand and limited supply.

| Global Crisis | Investor Behavior | Impact on Gold Demand |

|---|---|---|

| Financial Meltdowns | Investors sell off risky assets (stocks, bonds) and seek safe-haven assets like gold to preserve capital | Significant increase in demand for gold as investors seek to protect their wealth during market turmoil |

| Pandemics | Economic uncertainty and market volatility drive investors towards safe-haven assets like gold, while also disrupting supply chains | Sharp increase in demand for gold as a safe store of value, coupled with potential supply shortages due to disruptions in mining and refining |

| Geopolitical Conflicts | Increased risk aversion and uncertainty prompt investors to seek safe-haven assets like gold, while also driving up inflation expectations | Strong increase in demand for gold as investors seek to hedge against economic and political instability |

| Natural Disasters | Disruptions to economic activity and supply chains can lead to increased demand for gold as a store of value and a hedge against inflation | Moderate increase in demand for gold as investors assess the economic impact and seek to protect their wealth |

24. Gold as a Store of Value in Times of Uncertainty

Gold’s ability to act as a reliable store of value in times of uncertainty stems from its limited supply, historical significance, and perceived safety. Unlike fiat currencies, which can be printed by central banks, the supply of gold is finite, making it a hedge against currency devaluation and inflation.

- Limited Supply: Gold’s finite supply makes it a hedge against currency devaluation.

- Historical Significance: Gold has been a store of value for thousands of years.

- Perceived Safety: Investors view gold as a safe and reliable asset during uncertain times.

25. Gold and Cryptocurrency: A Comparative Analysis

Gold and cryptocurrency are both seen as alternative assets that can provide diversification and potential returns. However, they have distinct characteristics. Gold has a long history as a store of value, while cryptocurrency is a relatively new and volatile asset class. Understanding the differences between gold and cryptocurrency is essential for making informed investment decisions.

| Feature | Gold | Cryptocurrency |

|---|---|---|

| History | Thousands of years as a store of value | Relatively new asset class (since 2009) |

| Volatility | Generally less volatile than cryptocurrencies | Highly volatile, with significant price swings |

| Supply | Limited supply, but new gold is mined regularly | Limited supply for some cryptocurrencies (e.g., Bitcoin), but new cryptocurrencies are constantly being created |

| Use Cases | Store of value, inflation hedge, jewelry, industrial applications | Store of value (debatable), medium of exchange, smart contracts, decentralized applications |

| Regulatory Environment | Well-established regulatory framework | Evolving regulatory landscape, with significant uncertainty in many jurisdictions |

| Liquidity | Highly liquid, with well-established markets | Liquidity varies depending on the cryptocurrency, but generally less liquid than gold |

26. Diversifying Investment Portfolio with Gold

Diversifying an investment portfolio with gold involves allocating a portion of the portfolio to gold-related assets, such as physical gold, gold ETFs, or gold mining stocks. The optimal allocation depends on an investor’s risk tolerance, investment goals, and time horizon. The goal is to reduce overall portfolio risk and improve long-term returns by including an asset that is not highly correlated with other asset classes.

- Allocation Strategy: Allocate a portion of the portfolio to gold-related assets.

- Risk Tolerance: Adjust the allocation based on the investor’s risk tolerance.

- Diversification Benefits: Reduce overall portfolio risk and improve long-term returns.

27. Strategies for Hedging Risk with Gold

Hedging risk with gold involves using gold-related assets to offset potential losses in other parts of an investment portfolio. This can be achieved through various strategies, such as buying gold futures contracts or investing in gold mining stocks that tend to perform well during periods of economic uncertainty.

| Hedging Strategy | Description | Benefits | Risks |

|---|---|---|---|

| Buying Gold Futures | Purchasing gold futures contracts to profit from potential increases in gold prices during periods of economic uncertainty. | Potential for high returns, leverage, ability to profit from rising gold prices | Requires specialized knowledge, potential for significant losses if gold prices decline, margin calls |

| Investing in Gold Mining Stocks | Buying shares of gold mining companies that tend to perform well during periods of economic uncertainty. | Potential for high returns, leverage to gold prices, dividend income | Company-specific risk, operational challenges, regulatory risks, sensitivity to broader market conditions |

| Allocating to Gold ETFs | Including gold ETFs in a diversified portfolio to reduce overall portfolio risk and improve long-term returns. | Diversification benefits, liquidity, low storage costs, easy to trade | Counterparty risk, tracking error, expense ratios |

| Using Gold Options | Employing options strategies, such as buying call options on gold or writing covered call options, to hedge against potential losses. | Flexible, customizable, potential for generating income | Requires specialized knowledge, potential for significant losses, time decay |

28. Gold as a Safe-Haven Asset During Economic Downturns

Gold’s role as a safe-haven asset is particularly evident during economic downturns. Investors often flock to gold during these times as a way to preserve their wealth and protect against potential losses in other asset classes. This increased demand for gold can drive up its price, making it an effective hedge against economic uncertainty.

- Preserving Wealth: Gold is used to preserve wealth during economic downturns.

- Protection Against Losses: Gold protects against potential losses in other asset classes.

- Increased Demand: Increased demand drives up gold prices during economic uncertainty.

29. How Geopolitical Events Influence Gold Demand

Geopolitical events, such as wars, political instability, and international trade disputes, can significantly influence gold demand. These events create uncertainty and risk, prompting investors to seek safe-haven assets like gold. The perceived safety and historical significance of gold make it an attractive option during turbulent times.

| Geopolitical Event | Investor Behavior | Impact on Gold Demand |

|---|---|---|

| Wars | Investors seek safe-haven assets to protect their wealth during times of conflict and uncertainty. | Sharp increase in demand for gold as investors flee to safety, potentially driving up gold prices significantly. |

| Political Instability | Economic uncertainty and potential for policy changes drive investors towards stable assets like gold. | Increased demand for gold as investors seek to hedge against political risks, leading to moderate increases in gold prices. |

| International Trade Disputes | Increased uncertainty about economic growth and inflation leads investors to seek safe-haven assets. | Moderate increase in demand for gold as investors worry about the potential impact of trade disputes on the global economy. |

| Cyberattacks | Increased concerns about the security of financial systems and digital assets drive investors towards tangible assets like gold. | Moderate increase in demand for gold as investors seek a hedge against cyber risks and the potential for disruptions to the financial system. |

30. The Future of Gold as an Investment

The future of gold as an investment depends on a variety of factors, including economic conditions, geopolitical risks, and investor sentiment. While it is impossible to predict the future with certainty, understanding these factors can help investors make informed decisions about their gold allocations.

- Economic Conditions: Economic growth, inflation, and interest rates will influence gold demand.

- Geopolitical Risks: Wars, political instability, and international trade disputes can increase gold demand.

- Investor Sentiment: Investor perceptions of gold’s safety and value will impact its price.

Do you have more questions about why the gold price is increasing or other investment strategies? Visit why.edu.vn at 101 Curiosity Lane, Answer Town, CA 90210, United States, or contact us via WhatsApp at +1 (213) 555-0101. Our experts are ready to provide the answers you need.

FAQ: Frequently Asked Questions About Gold Prices

1. Why is gold considered a safe-haven asset?

Gold is considered a safe-haven asset due to its historical role as a store of value and its ability to maintain its worth during economic and political uncertainty.

2. How does inflation affect gold prices?

Inflation erodes the purchasing power of currencies, making gold an attractive hedge against inflation, which can drive up its price.

3. What is the relationship between interest rates and gold prices?

There is often an inverse correlation between interest rates and gold prices. When interest rates rise, gold prices may decline, and vice versa.

4. How do central banks influence gold prices?

Central banks can influence gold prices through their reserve management strategies, particularly by increasing or decreasing their gold holdings.

5. What are the different ways to invest in gold?

There are several ways to invest in gold, including purchasing physical gold, investing in gold ETFs, and buying shares of gold mining companies.

6. How does geopolitical risk impact gold prices?

Geopolitical events, such as wars and political instability, can increase gold demand as investors seek safe-haven assets.

7. Is gold a good investment for beginners?

Gold can be a good investment for beginners as part of a diversified portfolio, but it is important to understand the risks and potential returns.

8. What is the role of gold in portfolio diversification?

Gold plays a crucial role in portfolio diversification by providing a hedge against market volatility and economic uncertainty.

9. How can I hedge risk with gold?

You can hedge risk with gold by using gold-related assets to offset potential losses in other parts of your investment portfolio.

10. What are the key factors to consider when investing in gold?

Key factors to consider when investing in gold include economic conditions, geopolitical risks, and investor sentiment.