Elliott Management’s involvement with Hess Corporation is often cited as a prime example of activist investing’s short-term focus. However, a closer examination reveals a starkly different narrative – one where Elliott’s long-term engagement transformed Hess from an industry laggard into a top performer. This article explores Why Elliott Management targeted Hess and the demonstrably positive long-term impact of their involvement.

Elliott Management’s Hess Investment: A Catalyst for Long-Term Value Creation

Critics of activist investing frequently point to Elliott Management’s investment in Hess Corporation as evidence of short-term value extraction at the expense of long-term sustainability. This narrative, however, is fundamentally flawed and misrepresents the reality of Elliott’s involvement and its impact on Hess.

A common critique, for example, uses a flawed timeframe to assess Hess’s performance post-Elliott’s investment, conveniently omitting the initial 9% stock surge upon disclosure of Elliott’s involvement. This surge, typical in successful activist campaigns, reflects the market’s anticipation of positive change. Using the correct starting date reveals a 3.1% share price increase, contrary to the claimed 5.4% decline. Furthermore, including dividends, Hess’s Total Shareholder Return (TSR) reached 15.5% during the relevant period.

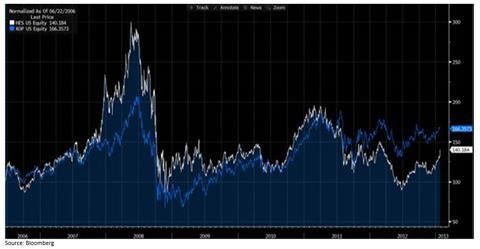

Hess’s share price lagged the industry before Elliott Management’s involvement.

Navigating Industry Headwinds: Hess’s Outperformance Under Elliott’s Influence

More significantly, critiques often ignore the broader energy market context. The period in question included a dramatic oil price crash, a significant headwind for any oil company. Despite this, Hess significantly outperformed its peers. While the SPDR Oil & Gas Exploration and Production ETF (XOP) suffered a 67.2% price loss and a negative 64.6% TSR, Hess generated positive returns, outperforming the index by over 70% and 80% on a price and total return basis, respectively.

Hess significantly outperformed the industry benchmark after Elliott Management’s involvement.

This outperformance underscores the resilience and strength that Elliott’s involvement helped foster within Hess. A $100 investment in Hess in January 2013 would have been worth over $115 in February 2020, compared to just $35 for the broader E&P index.

Beyond Share Price: Elliott’s Impact on Hess’s ESG Performance and Corporate Governance

Contrary to claims of neglecting long-term ESG (Environmental, Social, and Governance) initiatives, Hess consistently ranks among industry leaders in ESG metrics, even achieving the top spot in the S&P based on Bloomberg ESG Disclosure Scores. Elliott’s focus on improving corporate governance, the “G” in ESG, led to significant changes, including separating the CEO and Chairman roles and adding independent directors with relevant experience. These changes brought Hess in line with best practices in corporate governance.

Hess’s ESG ranking demonstrates a commitment to long-term sustainability.

Strategic Divestments: Positioning Hess for Long-Term Success

Elliott also influenced strategic divestments of non-core assets, generating approximately $12 billion before the oil market collapse. These sales, criticized by some, significantly deleveraged Hess’s balance sheet, enabling the company to weather the subsequent downturn. Had Hess retained these assets, they would have likely suffered substantial value impairment.

A Long-Term Vision: Elliott’s Seven-Year Commitment to Hess

Furthermore, the narrative of Elliott’s quick profit and exit is misleading. Elliott remained a top Hess shareholder for over seven years, a clear indication of a long-term commitment, not a short-term grab. This extended involvement contradicts the portrayal of Elliott as solely focused on short-term gains. Today, Hess is widely considered one of the best-positioned companies in its industry, a testament to the long-term value created by Elliott’s engagement. Even skeptical analysts acknowledge Hess’s strong long-term growth prospects, highlighting its “unique long-term cash flow growth” and “diversified model.” This hardly paints a picture of a company focused on short-term gains at the expense of long-term value.

Conclusion: Reframing the Narrative of Activist Investing

Elliott Management’s involvement with Hess Corporation serves as a powerful counter-narrative to the common criticisms of activist investing. Rather than short-term value extraction, Elliott’s engagement catalyzed significant long-term improvements in Hess’s operational performance, corporate governance, and financial health. This case study highlights the potential for activist investors to drive positive, sustainable change, benefiting both shareholders and stakeholders alike. The Hess transformation underscores the importance of looking beyond simplistic narratives and examining the actual long-term impact of activist involvement.