Bitcoin recently made headlines as it approached the $100,000 mark, leaving many investors and market observers wondering, “Why Did Bitcoin Go Up?”. This surge coincided with the release of the latest Consumer Price Index (CPI) data from the United States in December 2024, which unexpectedly rose. This article delves into the factors driving Bitcoin’s price increase, examining the relationship between US inflation, anticipated Federal Reserve actions, and the broader cryptocurrency market response.

US CPI Data Sparks Bitcoin Rally

On January 15, 2025, the U.S. Bureau of Labor Statistics (BLS) announced that the Consumer Price Index for All Urban Consumers (CPI-U) had increased by 0.4% in December. This figure, detailed in the BLS report, followed a 0.3% increase in November and pushed the overall 12-month inflation rate to 2.9%. This slightly higher-than-expected inflation reading had immediate repercussions across financial markets, particularly in the cryptocurrency sector.

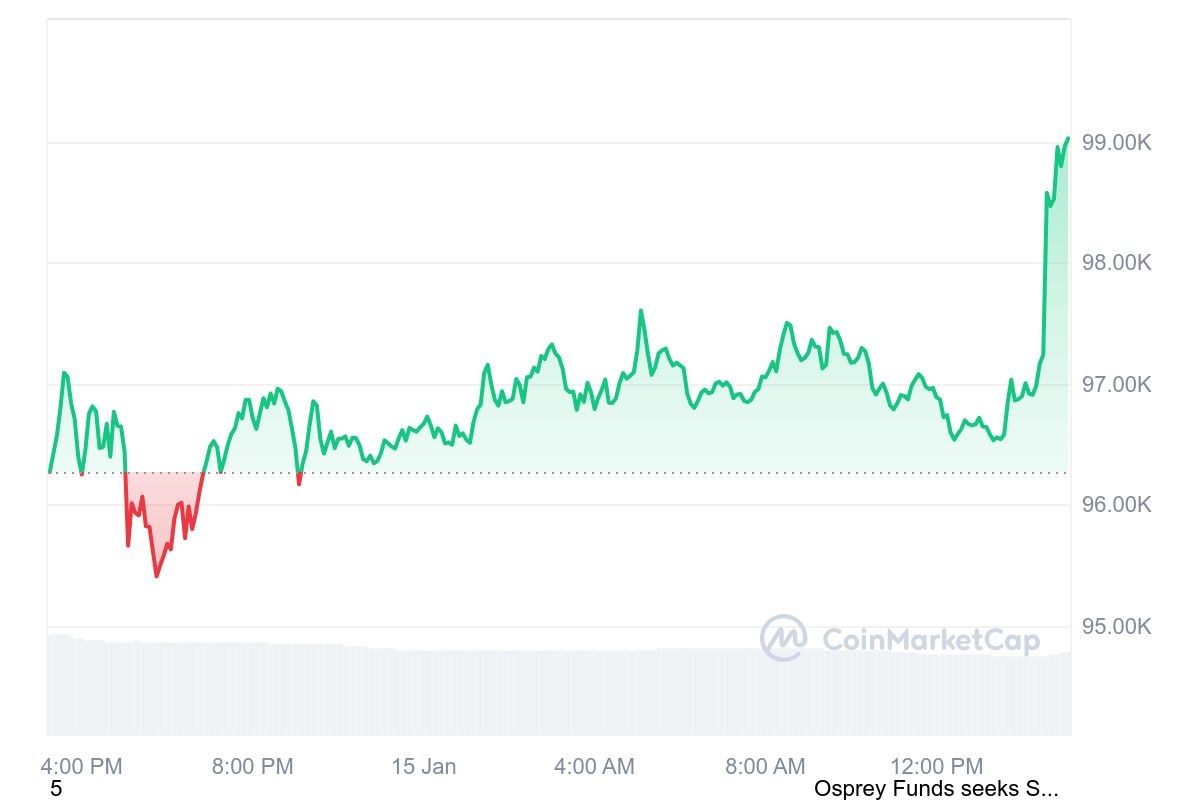

The unexpected CPI data release led to a significant reaction in the cryptocurrency market. Bitcoin, the leading cryptocurrency, experienced an immediate jump of 1.4%, climbing to $98,500. The momentum continued, and Bitcoin reached a daily high of $99,400. This price action was interpreted by many analysts as a validation of a bullish market signal that had emerged the previous day.

Rate Cut Anticipation Fuels Crypto Market Optimism

The key driver behind Bitcoin’s positive reaction to the inflation data lies in the anticipation of potential interest rate cuts by the Federal Reserve. Following the CPI announcement, the CME FedWatch Tool indicated an increased probability – up to 30% – of a rate cut as early as the Federal Reserve’s March meeting.

Investors interpreted the slightly elevated inflation as a sign that the Federal Reserve might be compelled to adopt a more dovish monetary policy sooner than previously anticipated. Lower interest rates typically make riskier assets, such as cryptocurrencies, more attractive to investors seeking higher returns. This expectation of easier monetary policy acted as a catalyst, propelling Bitcoin and the broader crypto market upwards.

Expert Analysis on Market Volatility and Future Outlook

Paul Howard, Senior Director at Wincent, a liquidity provider in digital assets, offered insights into the market dynamics. Speaking with Finance Magnates, Howard noted, “Crypto remains a key indicator of risk assets, and with CPI and inflation figures exceeding expectations, this improvement is evident in current pricing.”

Howard further highlighted the potential for market volatility in the near term, particularly with the upcoming US administration transition. He suggested that this transition could trigger significant price swings – possibly +/-10% – for major cryptocurrencies like Bitcoin, Ethereum, Solana, and XRP. He also pointed out that market pricing is likely to react to announcements from the incoming President, which could have long-term implications for cryptocurrency regulation, banking policies, and even the adoption of Bitcoin as a strategic reserve asset.

Altcoins Follow Bitcoin’s Ascent, Reflecting Market-Wide Sentiment

The positive sentiment triggered by Bitcoin’s rise extended to the altcoin market. Ethereum, the second-largest cryptocurrency by market capitalization, saw a 3% increase, reaching $3,300. XRP also experienced a significant jump, rising by 2.6% to $2.57.

This widespread rally led to a 5.6% increase in the total cryptocurrency market capitalization, pushing it to $3.33 trillion. Daily trading volume also surged by 25% to $154 billion, indicating strong market participation and renewed investor interest in digital assets.

Conclusion: Inflation Data as a Catalyst for Crypto Growth

In conclusion, the recent increase in Bitcoin’s price can be attributed to the release of US CPI inflation data for December 2024. While the inflation figure was slightly higher than anticipated, it was interpreted by the market as a potential signal for earlier Federal Reserve interest rate cuts. This anticipation of looser monetary policy fueled optimism in the cryptocurrency market, driving up the price of Bitcoin and subsequently lifting altcoins as well. While market volatility remains a factor, particularly with upcoming political and economic announcements, the short-term outlook for Bitcoin and the crypto market appears bullish, driven by macroeconomic factors and investor sentiment.