Bitcoin, the pioneering cryptocurrency, has experienced dramatic price fluctuations throughout its history. For investors, both seasoned and new, understanding why Bitcoin crashes is crucial for navigating the volatile crypto market. While the original article discusses reasons for selling Bitcoin after a price surge, we can pivot this to explore the very nature of Bitcoin crashes, drawing insights from the author’s experiences and concerns.

Historical Bitcoin Crashes: A Rollercoaster Ride

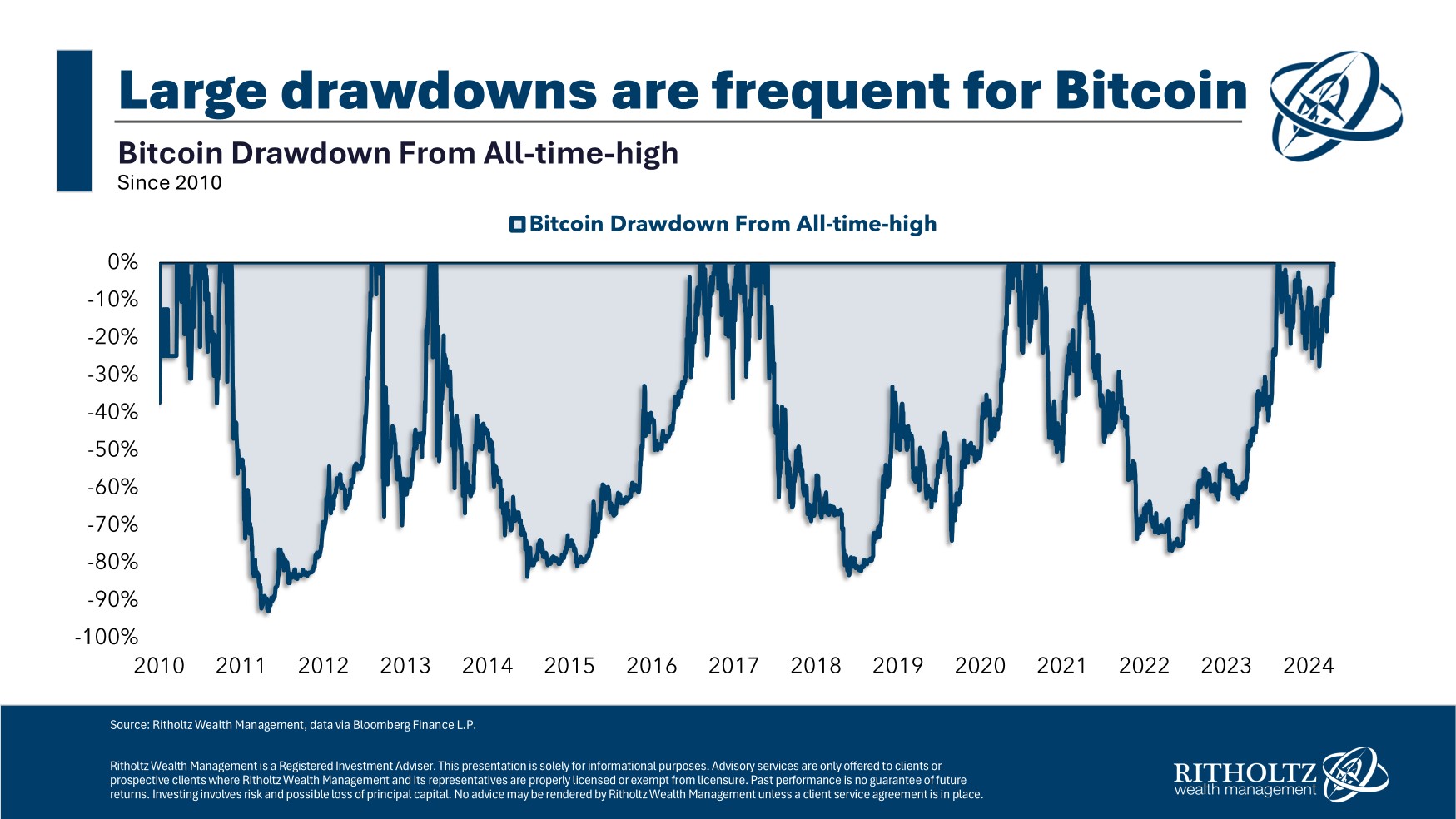

The author of the original article vividly recalls several significant Bitcoin crashes. They mention the sharp downturn following the 2017 boom, the pandemic-induced crash of March 2020 where Bitcoin lost half its value in two days, and the severe crash after the Sam Bankman-Fried (SBF) fiasco, which resulted in an approximately 80% drop. This historical perspective is vital to understanding Bitcoin’s inherent volatility. As depicted in the drawdown chart from the original article, Bitcoin has seen multiple “Great Depression-like crashes” in a relatively short period.

Bitcoin Historical Drawdown Profile

Bitcoin Historical Drawdown Profile

These past crashes weren’t isolated incidents but rather a pattern reflecting the nascent and speculative nature of the cryptocurrency market. Understanding these historical precedents helps contextualize current market downturns and manage expectations about future price movements.

Factors Contributing to Bitcoin Crashes

Several factors can trigger a Bitcoin crash. These can be broadly categorized as market-specific factors and broader economic influences:

-

Market Sentiment and Speculation: The crypto market is heavily driven by sentiment and speculation. Positive news can lead to rapid price surges, while negative news or even rumors can trigger sharp declines. Fear, uncertainty, and doubt (FUD) can spread quickly in online crypto communities, exacerbating price drops. Profit-taking after significant rallies can also contribute to downward pressure, as investors decide to secure their gains.

-

Regulatory Uncertainty: Governments worldwide are still grappling with how to regulate cryptocurrencies. Announcements of stricter regulations, bans, or even just increased scrutiny can send shockwaves through the market, leading to sell-offs and price crashes. Conversely, positive regulatory developments can sometimes boost prices, highlighting the sensitivity of crypto to regulatory news.

-

Technological Issues and Security Breaches: While Bitcoin’s blockchain technology is robust, exchanges and related infrastructure are not immune to hacks and security breaches. Major security incidents at crypto exchanges or within the broader crypto ecosystem can erode investor confidence and lead to market crashes. Concerns about the scalability and future technological developments of Bitcoin can also play a role.

-

Macroeconomic Factors: Bitcoin, while often touted as “digital gold” and a hedge against inflation, is not entirely immune to macroeconomic conditions. Interest rate hikes, inflation concerns, and economic recessions can impact all asset classes, including cryptocurrencies. During times of economic uncertainty, investors may reduce exposure to riskier assets like Bitcoin in favor of safer havens, contributing to price declines.

-

Whale Activity and Market Manipulation: The Bitcoin market, while growing, can still be influenced by large holders, often referred to as “whales.” Significant sell orders from these whales can trigger cascading sell-offs and contribute to market crashes. Concerns about market manipulation, including pump-and-dump schemes, also persist within the less regulated corners of the crypto space.

Is This Crash Different? Institutional Investment and Market Maturity

The original article touches on the idea that increased institutional investment, particularly through Bitcoin ETFs, might mitigate the severity of future crashes. The influx of institutional money and the growing involvement of traditional financial advisors could potentially stabilize the market and reduce the likelihood of 80% crashes seen in the past.

However, it’s essential to remain cautious. While institutional involvement might introduce some stability, it doesn’t eliminate volatility entirely. Bitcoin’s fundamental characteristics – 24/7 trading, global nature, lack of central authority, and absence of traditional valuation metrics – inherently contribute to price swings. Even with more institutional capital, significant corrections and crashes are still possible. As the author wisely points out, even if 80% crashes become less frequent, 40-60% crashes could still be expected.

Navigating Bitcoin Volatility: Risk Management is Key

Understanding why Bitcoin crashes is only the first step. The more important aspect is how to navigate this volatility effectively. The author’s decision to rebalance their portfolio and reduce their Bitcoin holdings as it approached $100,000 exemplifies a prudent risk management approach.

Here are key strategies for navigating Bitcoin’s volatile nature:

-

Portfolio Diversification: Do not put all your investment eggs in one basket, especially a volatile one like Bitcoin. Diversify your portfolio across different asset classes to mitigate the impact of a Bitcoin crash on your overall investments.

-

Position Sizing: Limit the percentage of your portfolio allocated to Bitcoin to a level you are comfortable with, considering its volatility. The original author’s target of 5% is a reasonable benchmark for many investors.

-

Dollar-Cost Averaging (DCA): Instead of trying to time the market, consider using DCA to invest in Bitcoin gradually over time. This strategy helps to average out your purchase price and reduce the risk of buying at market peaks.

-

Have a Plan and Stick to It: Develop a clear investment strategy for Bitcoin, including entry and exit points, and stick to your plan. Emotional decision-making driven by market hype or fear can be detrimental in the volatile crypto market.

-

Long-Term Perspective: Bitcoin is still a relatively young asset class. Adopting a long-term investment horizon can help you weather short-term volatility and potentially benefit from the long-term growth potential of cryptocurrencies.

Conclusion: Embracing Bitcoin’s Volatility with Caution

Bitcoin crashes are an inherent part of its market cycle, driven by a complex interplay of market sentiment, regulatory developments, technological factors, and macroeconomic conditions. While increased institutional involvement might moderate extreme volatility, significant price corrections remain a possibility. Understanding the reasons behind Bitcoin crashes and implementing robust risk management strategies are essential for anyone investing in this dynamic and often unpredictable asset class. As the original author’s experience shows, a balanced and strategic approach, acknowledging both the potential and the risks of Bitcoin, is crucial for long-term success in the crypto market.