Indexed Universal Life (IUL) insurance policies are often presented as a compelling way to grow your wealth while securing life insurance protection. At first glance, IULs can seem like an ideal financial product, promising market-linked returns, guarantees against losses, and attractive tax advantages. However, a closer look reveals a different story. For most people seeking to build a solid financial future, IUL policies typically fall short when compared to more straightforward and efficient investment options.

My own experience with an Indexed Universal Life insurance policy led me to uncover the complexities and drawbacks hidden beneath the surface. After carefully reviewing the policy details and doing the necessary calculations, I realized the hard truth about IULs. If you’re looking to understand the common misconceptions promoted by IUL agents and why this type of insurance might be a poor investment choice, this comprehensive guide is for you.

Key Takeaways

- IUL policies are complex financial products with numerous hidden fees that can erode returns.

- The touted tax benefits and market-linked returns of IULs are often less advantageous than those of alternative investment strategies.

- Before choosing an IUL or any permanent life insurance, it’s crucial to consider if term life insurance is a more suitable and cost-effective option for your needs.

- IUL policies are frequently marketed primarily as investments, obscuring their core function as insurance products.

- The projected returns of IUL policies usually fail to match the performance of traditional, low-cost index fund investments over the long term.

Understanding How Indexed Universal Life Insurance (IUL) Works

Indexed Universal Life (IUL) insurance is categorized as permanent life insurance, blending the features of universal life insurance with an investment-like component. Like any life insurance policy, IUL requires regular premium payments to maintain coverage. A portion of these premiums is allocated to cover the death benefit—the payout to your beneficiaries—while the remainder is channeled into a cash value savings account that is linked to a market index, such as the S&P 500.

The growth of your cash value account is dictated by the performance of the chosen market index. When the index performs favorably, your cash value account has the potential to increase. While IUL policies do offer features like the ability to borrow against your cash value or use it to pay premiums, it’s important to be aware of the potential downsides.

The typical sales narrative for IUL policies emphasizes several key points:

- Protection from market downturns due to a guaranteed “floor” that limits losses.

- The potential for competitive investment returns linked to market performance.

- Tax-advantaged growth and tax-free withdrawals under certain conditions.

- The concept of “being your own bank” through policy loans against the cash value.

While these selling points may sound appealing, it’s crucial to recognize that IUL policies are significantly more intricate and often less beneficial than these initial pitches suggest. For instance, the gains on your investment are not directly equivalent to market returns. Instead, they are typically subject to mechanisms like participation rates, interest rate caps, or a combination of both. These limitations can restrict the growth potential of your cash value account when compared to investing directly in the market through low-cost index funds.

Although IUL policies provide flexibility in premium payments and the opportunity to participate in market gains, they also carry substantial risks and disadvantages. Prior to making a decision, it is vital to thoroughly understand the policy’s terms and conditions, as IUL policies can be complex and may not be appropriate for most individuals.

The Intricacies of IUL Policies: Unveiling What You’re Not Told

Indexed Universal Life Insurance (IUL) policies are often presented as straightforward investment tools, but the reality is far more complicated. These policies are packed with complex terms and conditions that can be challenging to decipher.

Upon purchasing an IUL policy, you’ll encounter a range of fees that may not be immediately obvious:

- Administrative fees for policy management.

- Cost of insurance fees, covering the death benefit.

- Premium expense fees, charged as a percentage of each premium payment.

- Surrender fees, applied if you decide to cancel the policy early.

Furthermore, the growth of your cash value in an IUL policy, while tied to market indexes, is not as direct as it might seem. Your returns are influenced by:

- Participation rates, which determine the percentage of index gains credited to your account.

- Caps on gains, limiting the maximum return you can receive in a given period.

- Floors on losses, which provide a degree of protection against market downturns but also affect potential gains.

These factors can significantly impact your investment returns, often in ways that are difficult to predict or fully grasp without deep financial expertise.

IUL policies promote “flexible premiums” as an advantage, but this feature can be a double-edged sword. For instance, if the policy performs poorly, you might be required to pay higher premiums to maintain the policy in force and prevent it from lapsing.

Lastly, the cash value component of IULs is frequently promoted as a tool for retirement planning. However, accessing this cash value through loans can be problematic. If not managed carefully, these loans can:

- Reduce the policy’s death benefit, impacting the financial security for your beneficiaries.

- Potentially lead to policy lapse, especially if loan balances and interest accumulate beyond the cash value’s capacity to support them.

- Create unexpected tax liabilities, depending on how and when withdrawals are made.

Understanding how an IUL policy aligns with your broader financial plan requires careful and informed consideration. The inherent complexity of these policies means that it’s easy to misunderstand key features or overlook critical details, making it essential to seek expert advice and conduct thorough due diligence.

10 Reasons Why IUL is a Bad Investment

IUL insurance agents often paint a very convincing picture – a scenario I personally experienced when I purchased a policy. To help you learn from my experience and avoid making a similar mistake, here are 10 critical reasons why IUL is generally a poor investment choice.

1. Dividends Are Not Included in Performance Calculations

A common tactic in IUL sales is to compare the historical performance of the policy to the S&P 500 index without accounting for dividends. This selective presentation creates a misleading impression, making the IUL seem more competitive than it truly is. When dividends are properly included, the S&P 500’s actual performance is significantly higher than that typically achieved by Indexed Universal Life Insurance. Ignoring dividends substantially understates the real returns of market benchmarks against which IULs are often compared.

2. Carefully Selected Time Periods for Performance Data

When illustrating historical performance, insurance agents often choose specific timeframes that cast IUL policies in the most favorable light. For example, they might emphasize periods marked by high market volatility or downturns in the stock market to highlight the policy’s protection against losses. However, over longer, more representative periods, low-cost U.S. stock index funds have consistently outperformed IUL policies. This selective use of data can obscure the long-term underperformance of IULs compared to standard market investments.

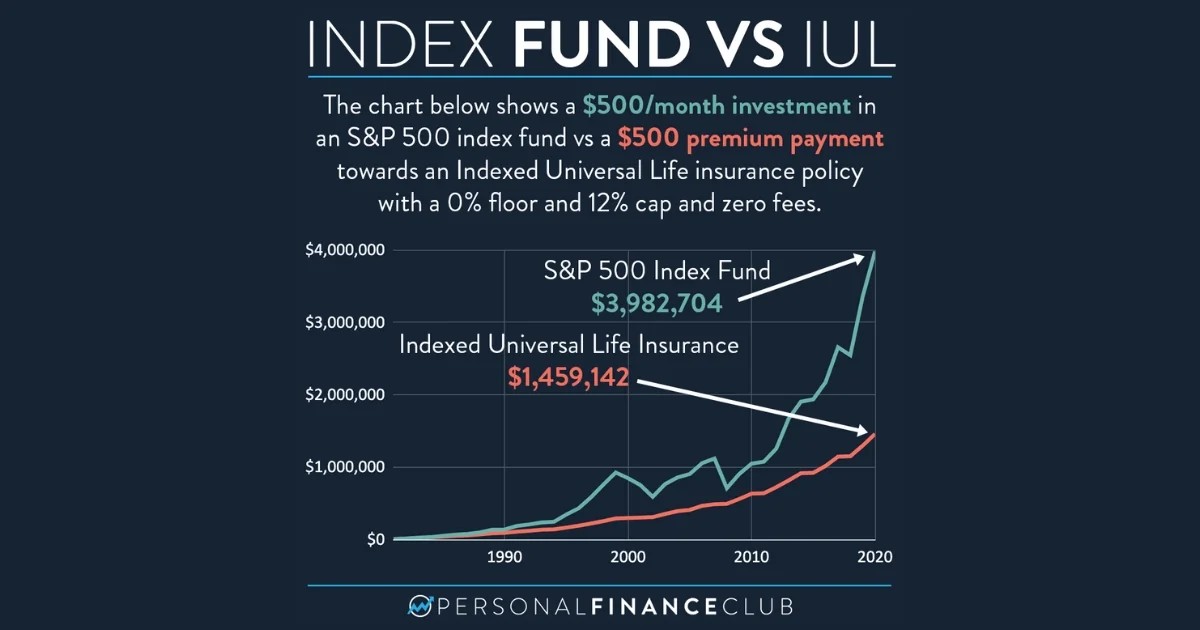

Chart comparing the performance of a low-cost S&P 500 index fund versus an Indexed Universal Life (IUL) policy since 1980, showing the index fund outperforming by over 100%.

Chart comparing the performance of a low-cost S&P 500 index fund versus an Indexed Universal Life (IUL) policy since 1980, showing the index fund outperforming by over 100%.

3. Hidden and Opaque Fees

IUL policies come with a multitude of fees that are often downplayed or not fully disclosed during the sales process. These can include:

- Premium expense charges: These can be a significant percentage of each premium payment, sometimes as high as 6%.

- Monthly policy fees: Regular charges just to maintain the policy.

- Per-unit charges based on the death benefit: Fees that scale with the size of your insurance coverage.

- Surrender charges for early policy termination: Substantial penalties if you decide to cancel the policy within a certain period.

- Index account charges: These are similar to the expense ratios in mutual funds and can reduce your credited interest.

These fees can significantly erode the policy’s cash value and diminish overall returns, making the net investment much less attractive than initially presented.

4. Substantial Insurance Costs

In addition to the various administrative and policy-related fees, policyholders must also bear the cost of the life insurance coverage itself. This cost of insurance (COI) is not fixed; it increases as you age, progressively reducing the cash value over time. While permanent insurance inherently involves these rising costs, it’s crucial to recognize their impact on the long-term value of an IUL. If permanent insurance is not a necessity for your financial planning, then an IUL becomes an even less justifiable investment choice.

5. Underperformance in Investment Returns

Despite claims of potentially market-beating performance, IUL policies typically deliver investment returns that are lower than those achieved by low-cost index funds over the long run. This underperformance is a direct result of the combination of embedded fees, caps on potential investment gains, and the inherently complex structure of these policies.

With low-cost index funds, the primary cost is the management expense ratio, which is usually minimal. In contrast, with an IUL policy, you are paying not only for the investment component but also for the insurance coverage and various policy administration costs. Given these additional layers of expenses, it’s not surprising that IULs generally fail to compete with the returns of traditional investments.

6. Exaggerated Claims of Tax Benefits

While IUL policies do offer certain tax advantages, these benefits are often overemphasized and can be misleadingly presented. For instance, the tax-free death benefit, frequently highlighted as a major advantage, is actually a standard feature of all life insurance policies, not exclusive to IULs.

Furthermore, the ability to borrow against the policy’s cash value on a tax-free basis is often touted as a unique benefit. However, this is essentially a loan, and like any loan, it comes with its own set of risks and costs, including the potential for interest accumulation and impact on the policy’s cash value and death benefit. There’s no truly “free lunch” when it comes to these features.

7. Misleading Assertions About Wealthy Investors

Insurance agents sometimes suggest that IUL policies are a favored investment tool among wealthy individuals. This claim is largely unfounded. Most high-net-worth individuals accumulate and manage their wealth through direct business ownership, real estate investments, and diversified portfolios including low-cost index funds, not primarily through IULs.

The reason some ultra-wealthy individuals may utilize permanent life insurance policies is primarily for estate planning purposes, specifically to help their heirs manage potential estate tax liabilities upon inheritance. Unless your estate is projected to exceed the federal estate tax exemption threshold (which is quite high, at $12.29 million for individuals and $24.58 million for married couples in 2022), permanent insurance policies like Indexed Universal Life are generally not necessary for tax planning.

8. The Fallacy of “Infinite Banking”

The concept of “being your own bank” by borrowing against your IUL policy is often promoted as a significant advantage. However, this strategy is encumbered by fees and risks, and the underlying cash value within the policy typically grows at a much slower rate than a well-managed traditional investment portfolio.

A more effective approach to “being your own bank” is simply to enhance your financial health: earn more, save more, and avoid costly and inefficient financial products like IULs. Building a robust financial plan and maintaining a healthy cash reserve provides true financial flexibility and access to funds when needed, without the complexities and costs associated with policy loans.

9. The “You’re Doing It Wrong” Rebuttal

When criticisms of IUL policies are raised, some insurance agents may argue that the policy was not “properly structured.” However, the fundamental drawbacks of IULs are inherent to the product design and persist regardless of specific policy configurations.

An IUL policy is essentially a combination of permanent life insurance with an investment component. Given that permanent life insurance is not a necessary or optimal product for the vast majority of individuals (approximately 99.9% of the population), the issue isn’t about structuring the policy incorrectly; it’s about the inherent nature of the product itself. The insurance company acts as an intermediary, packaging together components that are often not in the best interest of the consumer, which is a core reason why IUL is a questionable investment.

10. Unfavorable and Restrictive Terms

While IUL policies may present some superficially attractive features, they also include numerous unfavorable terms that are often not thoroughly explained. These include:

- Withdrawal fees: Charges for accessing your cash value, depending on the withdrawal method and policy terms.

- Delays in accessing cash value: Policies may impose waiting periods or restrictions on when and how quickly you can access your funds.

- Discretionary changes by the insurance company: The insurance company typically retains the right to alter fees, participation rates, and interest rate caps at their discretion, potentially affecting future policy performance.

- Loss of cash value upon death: Upon the policyholder’s death, only the death benefit is paid out to beneficiaries; the accumulated cash value is retained by the insurance company.

If you have determined that life insurance is a necessary part of your financial plan, a more prudent strategy than purchasing an Indexed Universal Life policy would be to:

- Accurately assess how much life insurance coverage you actually need.

- Opt for term life insurance, which is significantly more affordable than IUL policies and provides coverage for a specific term.

- Invest the money saved by choosing term life insurance into low-cost index funds or other efficient investment vehicles.

By separating your insurance needs from your investment strategy, you can achieve better financial protection and potentially higher investment returns while maintaining greater transparency and control over your finances.

Important Questions to Ask Before Purchasing IUL

If you are still considering an IUL policy, it’s crucial to ask these key questions before making a purchase:

- How are the premiums structured? – Understand if premiums are flexible, how they can change over time, and what happens if you pay more or less than planned.

- What are the stock market index options for growth? – Identify which specific market indices the policy is linked to and how their performance directly impacts your cash value growth.

- What are the cap and participation rate? – Know the maximum annual return (cap) and the percentage of the index’s gains you will actually receive (participation rate).

- What is the guaranteed interest rate? – Determine the minimum interest rate credited to your account even if the linked index performs poorly.

- How flexible are premium payments? – Clarify the extent to which you can adjust premium payments over time and the implications of doing so.

- What are all the fees and charges? – Get a detailed breakdown of all potential fees, including mortality charges, administrative fees, surrender fees, and any other costs that could reduce the policy’s benefits.

- Can loans or withdrawals be taken against the policy? – Understand the terms for accessing the cash value through loans or withdrawals, including any associated fees and tax implications.

- What are the tax implications? – Clarify how the policy’s cash value and death benefit are treated for tax purposes, both during accumulation and at distribution.

- How will changes in interest rates or the market affect my policy? – Understand how broader economic factors, such as market fluctuations and interest rate changes, could impact the performance and long-term viability of the policy.

Seeking clear and comprehensive answers to these questions is essential to fully understand the features, risks, and potential benefits—or lack thereof—of an IUL policy before making any commitments.

Frequently Asked Questions

Are there any situations where an IUL policy might be appropriate?

While rare, there might be very specific scenarios where an IUL policy could be considered, such as for high-net-worth individuals with highly complex estate planning needs or unique financial situations. However, for the vast majority of people, separating insurance and investments typically remains a more effective and transparent financial strategy.

How can I tell if an insurance agent is giving me honest advice about IUL policies?

Be cautious of agents who tend to downplay fees, present overly optimistic and potentially unrealistic return projections, or pressure you to make a quick decision without thorough consideration. Always request a complete policy illustration that clearly details all fees and charges. It’s also wise to seek a second opinion from a fee-only financial advisor who does not sell insurance products and can provide unbiased advice.

What should I do if I already own an IUL policy?

If you currently own an IUL policy, it’s important to conduct a thorough review of your policy documents, paying close attention to all fees, charges, and projected returns. Consider consulting with a fee-only financial advisor to get an objective evaluation of whether continuing with the policy aligns with your financial goals or if exploring alternative strategies would be more beneficial for your specific situation.

What are the fees associated with IUL insurance?

The fees associated with Indexed Universal Life (IUL) insurance policies can be substantial and multifaceted. They commonly include administrative fees, mortality and expense (M&E) charges, premium loads, and surrender charges, among others. The specific fees can vary significantly depending on the policy and the issuing insurance company, so it’s crucial to fully understand these costs when evaluating an IUL. The lack of transparency surrounding these fees is a significant reason why many financial experts consider IULs to be a poor investment choice for most people.

How does IUL compare to a Roth IRA?

When comparing IUL to a Roth IRA, it’s essential to differentiate between insurance products and investment vehicles. An IUL is fundamentally a permanent life insurance policy that incorporates a death benefit with a cash value component linked to a market index like the S&P 500. Conversely, a Roth IRA is a dedicated retirement savings account that offers tax-free growth and, under specific conditions, tax-free withdrawals as long as certain rules are met. Roth IRAs generally provide greater transparency, flexibility, and are characterized by significantly lower fees compared to IULs, making them a more straightforward and often more advantageous choice for retirement savings for most individuals.

What are some common IUL pros and cons?

IUL policies offer a few potential benefits, including the potential for tax-deferred cash value growth, permanent life insurance coverage, and some flexibility in premium payments. However, they also come with significant drawbacks, such as high and often opaque fees, capped investment potential, complexity in understanding policy mechanics, and potential for underperformance compared to market benchmarks. Due to these factors, most financial experts do not typically recommend IUL policies as a primary investment or insurance solution.

Which companies offer IUL investments?

Numerous insurance companies offer IUL policies, including major providers like Prudential, Transamerica, and Pacific Life, among others. It’s important to note that the specific terms, features, fees, and potential returns can vary widely across different policies and providers. Therefore, thorough research and comparison of multiple options are essential if you are considering an IUL policy.

Can you lose money in an IUL?

While IUL policies are designed to provide a degree of protection against market downturns through guaranteed minimum interest rates or “floors,” it is indeed possible to lose money in an IUL. The overall success of an IUL policy is highly dependent on its specific terms, the level of fees charged, and the actual performance of the linked index. If the cash value growth is insufficient to offset the policy’s fees and costs over time, losing money is still possible. Furthermore, surrender charges and policy lapses can also lead to financial loss.

How much can you invest in an IUL annually?

Unlike qualified retirement accounts like 401(k)s or IRAs, IUL policies do not have explicit annual contribution limits set by tax regulations. Instead, the premiums are determined based on factors such as the desired death benefit, the policyholder’s age, and health status. However, it’s critical to be aware that excessively high premium payments relative to the death benefit could cause the policy to be reclassified as a Modified Endowment Contract (MEC) by the IRS. MEC status can lead to adverse tax implications on policy loans and withdrawals. Consulting with an insurance agent or a financial advisor is crucial to ensure that your IUL policy remains in a non-MEC status and aligns with your overall financial planning.

🎙️ Podcast: Why You Should Avoid Indexed Universal Life Insurance

Want to delve deeper into the topic of Indexed Universal Life Insurance (IUL) policies?

In this podcast episode, I share the primary reasons why I advise against IULs, explicitly exposing the misleading information I encountered when I purchased a policy myself. 👇